There are many reasons life insurers are moving toward the adoption of mobile capabilities. The top three reasons for mobile initiatives are:

- Keep pace with competitors – 84%

- Keep pace with consumer demand – 80%

- Provide better service to policy owners – 78%

The greatest opportunity for growth in the mobile capabilities area is with policy owners, LIMRA notes. Ideally, a policy owner should be able to complete simple service transactions via a mobile device without the involvement of an agent.

Going mobile

LIMRA’s survey finds 8 in 10 companies that offer mobile access for policy owners provide them with the ability to view policy information via a mobile device. However, only 19 percent offer the ability to purchase additional products/coverage via a mobile device, and just 10 percent offer the ability to chat with customer service personnel via a mobile device.

While relatively few policy owners may use these services now, prior LIMRA research shows that some consumers say they would not do business with an insurer that does not offer mobile access options.

In addition, two in three companies report at least some success with their mobile initiatives for policy owners. This is usually measured by the number of times the mobile site is accessed or from policy-owner feedback.

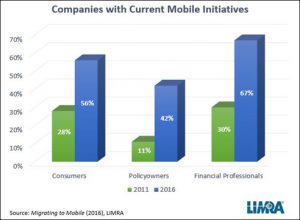

Mobile access for policy owners is advancing more slowly than access for consumers and financial professionals, but given the likely increase in demand, most companies that were surveyed plan to expand their offerings to policy owners soon.

These results were based on an electronic survey sent to North American companies in September and October of 2016. Forty-four companies in the U.S. and eight companies in Canada participated.

LIMRA