This is just a sample of the webinars you'll find in our archives.

-2.png?width=297&height=198&name=Jordan%20M.%20Skog%2c%20J.D.%20CLU%C2%AE%20ChFC%C2%AE%20CFP%C2%AE%20-%20LinkedIn%20Post%20(1104x736px)-2.png)

.png?width=297&height=198&name=AT%20Webinar%20-%20How%20to%20Increase%20Your%20Annuity%20Sales%20-%20Podcast%20-%20LinkedIn%20Post%20(1104x736px).png)

Bryan Albert of Eagle Life, Ellen Donovan of Allianz, and Rona Guymon of Nationwide Financial discuss why annuities are a key part of a holistic financial plan. The session was moderated by NAIFA President Bryon Holz.

-1.png?width=297&height=198&name=Schyler%20Adam%20%20LinkedIn%20Post%20(1104x736px)-1.png)

During this presentation, Schyler Adams of Allianz, analyzed a case study and made adjustments to how we are drawing down our assets to look at the impact has on the Monte Carlo score.

.png?width=1000&height=620&name=Toby%20Kominek-%20Blog%20Post%20(1000%20%C3%97%20620%20px).png)

On May 31, NAIFA's Advisor Today hosted the webinar, "How Supplemental Products Can Grow Your Business." During this presentation, Toby Kominek of LifeSecure Insurance Company shared how supplemental products can provide a whole health solution for your clients and offer advantages to agents looking to grow their business.

.png?width=1000&height=620&name=Ryan%20Mattern%20Blog%20post(1000%20%C3%97%20620%20px).png)

On March 27, NAIFA’s Advisor Today hosted the webinar “What Advisors Need to Know About Upcoming Illustration Changes," with Ryan Mattern of Modern Life, and Greg Rohtstein and Steven Patrizio of Symetra. In this webinar, our panel explained upcoming regulation changes to Indexed Universal Life Insurance likely to take place in May 2023, and what advisors can do to prepare for these changes.

On March 23, NAIFA’s Advisor Today hosted the webinar “Changing the Conversation" with NAIFA's Executive Director of the Centers of Excellence and author of the new bestseller How Not to Pull Your Family Apart, Carroll Golden. In this webinar, Carroll shared a three-step formula to show how to incorporate Financial Longevity Wellness in the products/services advisors provide while staying focused on their client’s stories.

Get your copy of Carroll's new book at TheCaringConversation.com.

.jpg?width=1000&height=620&name=Joe%20Templin%20BlogPost%20(1000x620px).jpg)

Many people get burnt out in the insurance and financial services industry because they are spinning their wheels, not making enough money, and not growing as a professional and a person.

In this Advisor Today webinar, join NAIFA Coaches Circle leader Joe Templin, MEC, CEC, CAP, ChFC, CLU, as he teaches you how to have balance and growth, to build a sustainable and profitable business you love.

.jpg?width=302&height=201&name=Dan%20Mangus%20LinkedIn%20Post%20(1104x736px).jpg)

Join Dan Mangus as he guides you through the ins and outs of buying or selling an agency and the top things you need to know when it comes to Medicare.

While many advisors are well-equipped to help their clients evaluate their life insurance needs, some scenarios may call for outside-of-the-box solutions.

Life insurance experts Ryan Mattern and Brandon Parry of Modern Life will walk attendees through four conversations where life insurance is commonly overlooked but can still play an important role in helping advisors secure their clients' futures.

Download the Presentation Slides

In this fast-paced webinar, Karl Kreunen showcases Ohio National’s new Prestige 10 Pay Indexed Whole Life policy. The discussion centers on why this product makes sense today and in the future with a quick overview of the internal workings of the policy. Additionally, this webinar includes a helpful demonstration of relevant sales applications for a multi-pay indexed whole life policy.

Why is client relationship marketing important? Learn how to avoid the cycle of chasing new clients from ReminderMedia President and Advisor Today contributor Luke Acree. This webinar will help you discover how top companies create raving fans; learn what type of content to send to your clients and how often; and learn how to connect with spouses, build trust with the next generation, and increase your AUM.

A significant percentage of financial advisors do not have a meaningful relationship with their clients' adult children. In this webinar, Simon Reilly discusses why many financial advisors don't have a meaningful relationship with their clients' adult children—and what you can do to cultivate those relationships.

Dave Resseguie began his career in the financial services industry in August of 2007. He spent 10 years working in leadership roles within both Northwestern Mutual & MassMutual agencies in Chicago, Ft. Lauderdale, & Miami. He specialized these roles in coaching leadership teams and top-performing financial advisors. In April of 2011, Dave began what many refer to as a "side hustle." As Chief Shepherd of The Resseguie Group, Dave works virtually and in-person, with leadership teams & entrepreneurs as they lead themselves, lead others, & lead their businesses.

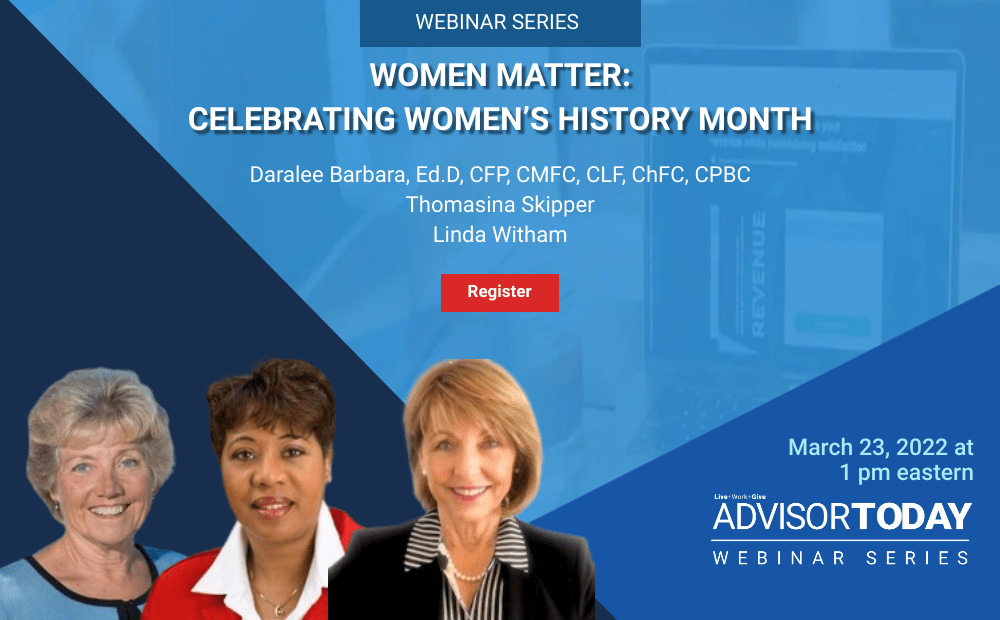

These seasoned Financial Services professionals will address the role of women as advisors, women as clients, and the important tools needed for gender parity in financial services. You'll hear practical strategies for making gender diversity a part of your culture, making everyday language inclusive, and finding women with the potential to excel as financial advisors, as well as practical tips you can start implementing today.