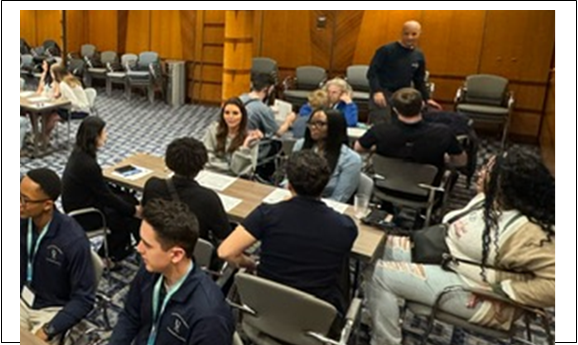

NAIFA is pleased to extend an invitation to the 2026 Financial ConNEXTion cruise conference, an experience that goes beyond professional development and taps into the future of our industry. Created by the Society of Financial Service Professionals (FSP) with NAIFA continuing the legacy, this initiative is designed to build bridges between NEXTGen talent and the financial services community.

NAIFA

Recent posts by NAIFA

2 min read

Financial ConNEXTion is unique educational and networking event at sea

By NAIFA on 8/14/25 1:31 PM

Topics: Education #MemberBenefits

4 min read

Five NAIFA Legends to Be Honored as Hall of Fame Inductees

By NAIFA on 8/13/25 12:54 PM

NAIFA is pleased to announce five new inductees into the NAIFA Hall of Fame. The NAIFA Board of Trustees authorized the creation of the Hall of Fame last year to recognize and celebrate members whose extraordinary service and contributions represent the legacy of the most accomplished, impactful, and inspirational members of the NAIFA family.

The 2025 NAIFA Hall of Fame Inductees are:

- Peter C. Browne, LUTCF*

- Ben Feldman*

- Terry K. Headley, LUTCF, FSS, LIC*

- Robert M. Nelson, CLU, LUTCF, FSS

- Lester A. Rosen*

Topics: Awards Press Release

1 min read

NAIFA Past President Mark Johnson Has Passed Away

By NAIFA on 8/8/25 4:03 PM

With great sadness, we share the news that NAIFA Past President Mark D. Johnson, CLU, RHU, ChFC, passed away on July 28. He served as President of NAIFA (then known as NALU) during the 1997-1998 association year and was the Chair of Life Happens (then, the Life and Health Insurance Foundation for Education) in 2006. While a member of NAIFA’s Board of Trustees in the mid-1990s, he led an important Strategic Planning Task Force that shaped the association’s direction for many years to follow. After his term as President, Mark continued as a volunteer leader providing guidance for NAIFA’s Advisor Today magazine. Prior to his national leadership, Mark was President of NAIFA-Minnesota and NAIFA-Lake Superior.

Topics: Leaders

4 min read

NAIFA Announces Candidates Nominated for 2026 National Leadership Roles

By NAIFA on 8/7/25 10:22 AM

NAIFA’s Committee on Governance has nominated Carina Hatfield, LUTCF, CLCS, LACP, agency owner of Weigner Insurance & Financial Services, Inc. in Pottstown, Penn., to be the 2026 NAIFA Secretary. Hatfield, who currently serves on the Life Happens Council and NAIFA’s National Membership Committee and Government Relations Committee, is a NAIFA-National Trustee and Past President of NAIFA-Pennsylvania. She has been a NAIFA member since 2005. As incoming Secretary, Hatfield will be in line to serve as President-Elect in 2027 and President in 2028.

Topics: Press Release Leaders

4 min read

NAIFA Past President Robert Miller to Receive the Life Insurance Industry’s Highest Honor

By NAIFA on 8/1/25 8:38 AM

Robert A. Miller, M.S., M.A., of New York City and Vero Beach, Florida, a retired Managing Partner at Miller-Pomerantz Insurance and Financial Services in New York City and NAIFA Past President, has been selected as the 2025 John Newton Russell Memorial Award recipient. The award is the highest honor accorded by the insurance industry to a living individual who has rendered outstanding services to the institution of life insurance. Miller will be celebrated and formally presented the award at NAIFA’s Belong Dinner, October 14 in Arlington, Virginia.

Topics: Awards Press Release Leaders

1 min read

Kevin Mayeux Highlights Importance of Private-Sector Retirement Solutions

By NAIFA on 7/25/25 9:30 AM

As more states launch automatic retirement savings programs for private-sector workers, the national conversation around retirement readiness is growing. A recent article in Stateline explores how states like Nevada and Colorado are addressing this issue through auto-IRA programs designed to reach workers without access to employer-sponsored plans.

2 min read

NAIFA CEO Kevin Mayeux Highlights the Financial Strain of Caregiving

By NAIFA on 7/17/25 2:38 PM

NAIFA CEO Kevin Mayeux’s latest column, The Bipartisan Kindness of Caregiving, is featured in InsuranceNewsNet. In this piece, Kevin brings national attention to the financial burden faced by millions of Americans who care for aging parents and loved ones. His message is clear: Caregiving is both an act of love and a financial challenge that deserves bipartisan legislative support.

Topics: caregiving

1 min read

Your Commitment Deserves Recognition: Apply for NAIFA’s National Quality Award

By NAIFA on 7/14/25 3:43 PM

Call for Nominees: 2025 NAIFA National Quality Award

Application Deadline: July 31, 2025

2 min read

Social Security Unlocked: Maximizing Benefits & Guiding Your Clients

By NAIFA on 7/14/25 11:43 AM

Social Security remains one of the most important and often misunderstood components of retirement income planning. For financial professionals, helping clients navigate the complex claiming rules and optimize their benefits can make a meaningful difference in their long-term financial security.

Join us on Wednesday, August 6, 2025, from 12:00 to 1:00 pm Eastern for a webinar with Martha Shedden, RSSA, CRPC, President and Co-founder of the National Association of Registered Social Security Analysts. This webinar is free for both members and non-members, thanks to co-sponsorship by RSSA.

NJBiz Opinion Column from NAIFA Trustee: Keep NJ insurance agents independent

By NAIFA on 7/7/25 2:18 PM

In his column published in both the print and digital editions of NJBiz, NAIFA national Trustee Dennis Cuccinelli, a member of NAIFA-New Jersey, warns that the state's proposed reclassification of insurance agents as employees instead of independent contractors would limit agents' independence, reduce consumer choice and potentially harm families' access to financial protection.

.png)

.png)

.png)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)