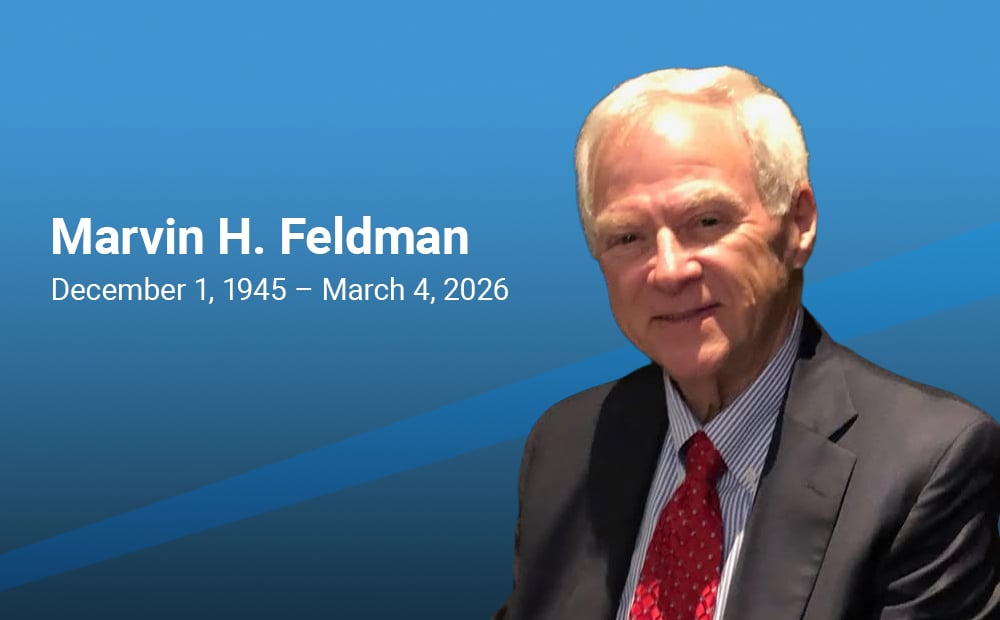

The National Association of Insurance and Financial Advisors (NAIFA) mourns the passing of Marvin H. Feldman, CLU, ChFC, RFC, a respected industry leader, mentor, and lifelong advocate for the importance of life insurance and financial protection. Feldman passed away March 4, 2026, in Palm Harbor, Florida, surrounded by his family.

3 min read

NAIFA Remembers Industry Leader and Advocate Marvin H. Feldman

By NAIFA on 3/5/26 11:46 AM

2 min read

NAIFA Strengthens Initiative to Grow Group Sales

By NAIFA on 3/2/26 4:23 PM

ARLINGTON, VA — With a keen aim to grow the number of financial professionals involved in the industry’s oldest and largest professional association, the National Association of Insurance and Financial Advisors (NAIFA) has appointed Gwenn Marsh as Senior Director, Group Membership Sales. This newly created role will help bolster NAIFA’s efforts at engaging the next generation of insurance and financial advisors in the profession.

2 min read

NAIFA and Brokers Ireland Launch Global Partnership to Elevate Professional Development and Industry Advocacy

By NAIFA on 3/2/26 2:32 PM

Arlington, VA (March 2, 2026) — The National Association of Insurance and Financial Advisors (NAIFA) and Dublin-based Brokers Ireland have announced a new strategic international partnership focused on professional development, thought leadership, and public policy collaboration. The agreement reflects a shared commitment to strengthening the insurance and financial service profession while expanding opportunities for advisors and brokers in both countries.

2 min read

NAIFA Selects James Lammers as the Kenneth Black Jr. Leadership Award Winner

By NAIFA on 2/26/26 11:27 AM

The Omaha, Nebraska financial professional has served as an inspirational leader within NAIFA and the Society of Financial Service Professionals.

2 min read

NAIFA Honors KHI Solutions as the 2025 100% Agency of the Year

By NAIFA Membership on 2/24/26 10:11 AM

NAIFA 100% Agencies ensure that every eligible producer within their ranks is a current and active NAIFA member.

NAIFA is proud to recognize KHI Solutions of Fort Dodge, Iowa, as the recipient of the 2025 NAIFA 100% Agency of the Year Award.

KHI Solutions, led by owners Brenda Eckard and Lynn Schreder and VP of Finance & Operations Misty Bethel, exemplifies the values and professionalism that define NAIFA’s membership. With over 30 NAIFA members across their team, KHI’s ongoing commitment to excellence, ethical service, and full participation makes them a standout example of what it means to be #NAIFAProud.

We Need Your Input on Succession Planning & Professional Development

By NAIFA on 2/23/26 2:23 PM

The profession is facing a major transition. Over the next decade, an estimated 100,000 financial advisors (nearly 40% of the workforce) are expected to retire, putting 42% of industry assets in motion. Yet more than one in four advisors do not have a succession plan.

1 min read

InvestmentNews Magazine Calls for Nominations of Top Female Advisors

By NAIFA on 2/23/26 2:07 PM

NAIFA is partnering with InvestmentNews magazine in a call for nominations for top advisors who will be celebrated in the magazine’s 2026 Special Reports.

1 min read

Comprehensive Estate Planning: Your Competitive Edge for 2026

By NAIFA on 2/20/26 11:12 AM

Estate planning continues to evolve, and 2026 is shaping up to bring important developments that financial professionals cannot afford to overlook. From tax updates to shifting rules around inherited retirement accounts, staying current is essential to delivering meaningful value to clients.

1 min read

Social Security Literacy and Income Planning: The Missing Link in Insurance and Financial Advice

By NAIFA on 2/20/26 10:51 AM

NAIFA’s upcoming webinar, "Social Security Literacy and Income Planning: The Missing Link in Insurance and Financial Advice", focuses on one of the most influential yet frequently oversimplified components of retirement planning.

2 min read

Legacy. Preparation. Greatness. A Call to Advisors

By NAIFA on 2/19/26 9:22 PM

In his address to FSP Institute attendees Feb. 19 in Orlando, NAIFA President Christopher Gandy welcomed the NAIFA members with a powerful reminder: This gathering represents more than advanced education; it represents the future of a profession built on more than 130 years of purpose.

4 min read

The Truth Regarding Financial Resolutions

By Ike Trotter on 2/18/26 2:19 PM

Current data continues to bear out the fact that new year’s resolutions do not stick. In fact, of those who set financial resolutions at the beginning of each new year, statistics tell us that 64% have already given up on them by the end of January. Sadly, just 9% successfully stick with their resolutions throughout the whole year.

3 min read

NAIFA and Coventry Announce Newly Expanded Relationship

By NAIFA on 2/17/26 9:42 AM

Under the agreement, Coventry will be NAIFA’s national Gold sponsor in the category of life settlements.

The National Association of Insurance and Financial Advisors (NAIFA) and Coventry have formalized a category-exclusive national sponsorship designed to expand advisor education and access to resources related to life settlements and the secondary market for life insurance. Coventry will serve NAIFA’s members as the exclusive life settlement category Gold sponsor, supporting NAIFA’s national activities and events.

3 min read

NAIFA Community: Members in Action

By NAIFA on 2/12/26 2:54 PM

“NAIFA Community: Members in Action” is a new publication that tells the stories of NAIFA members by showing how they make the most of NAIFA’s Advocate, Educate, Differentiate membership promise. NAIFA CEO Kevin Mayeux writes that the report “highlights the deeds and achievements of 10 extraordinary NAIFA members and contributors and demonstrates how their participation in the NAIFA experience has boosted their professional success and helped them better serve industry colleagues, clients, and others within their spheres of influence. Each one is a microcosm, representing the ways that thousands of financial professionals also make the most of their NAIFA experiences to bolster their own success and benefit others.”

1 min read

The Paul S. Mills Scholarship Program Seeks Applicants

By NAIFA on 2/9/26 4:11 PM

NAIFA's Foundation for Financial Service Professionals seeks applicants for the Paul S. Mills Scholarship program. The program offers scholarships to students pursuing degrees in financial service related fields, including finance, accounting, insurance or risk management, actuarial sciences, and personal financial planning. The application deadline is March 31.

2 min read

Christopher Cain, CLU - 50 Year National Quality Award Recipient

By NAIFA Membership on 2/6/26 4:12 PM

Christopher Cain, CLU, is a loyal NAIFA member who has spent more than five decades building a career defined by service, consistency, and enduring client relationships. A member since 1973, Chris is being recognized as a 50-year National Quality Award Recipient—an extraordinary achievement that reflects a lifetime commitment to professionalism and excellence in the financial services industry.

7 min read

Explore the Medicarians Vegas 2026 Agenda

By NAIFA on 2/2/26 3:39 PM

|

2 min read

Building Trust Across Generations: A Member Spotlight on Donald F. Vendetti, Jr.

By NAIFA Membership on 1/30/26 2:03 PM

Donald F. Vendetti, Jr., known to most as “Donny,” has been a proud NAIFA member since 1997 and currently serves clients from his office in South Dennis, Massachusetts, as part of Baystate Financial. Over nearly three decades in the financial services industry, Donny has built a career rooted in trust, education, and a genuine desire to help people achieve financial security and peace of mind.

2 min read

If it’s February, it’s Insure Your Love Month

By NAIFA & Life Happens on 1/30/26 11:30 AM

Most people don’t like talking about endings and dare we say, death. That’s what makes February’s Insure Your Love campaign so spot on. It allows you to link life insurance with love, a topic most people do want to talk about.

1 min read

2026 New Developments and Planning Ideas

By NAIFA on 1/29/26 9:53 AM

NAIFA’s Investment, Retirement, Estate, and Advanced Planning Center will host a free live webinar, 2026 New Developments and Planning Ideas, on Wednesday, February 4, 2026, from 12:00 noon to 2:00 pm Eastern. This webinar is open to everyone and is designed for financial professionals who want a clear, practical review of recent legal and regulatory changes and how those developments translate into real planning opportunities for clients.

5 min read

Why This Work Matters: Michael Schutza, TPCP®, on Purpose, Planning, and Impact

By NAIFA Membership on 1/23/26 11:40 AM

For Michael Schutza, TPCP®, financial services isn’t a job. It’s a responsibility. One shaped by lived experience, service, and a deep belief that the right guidance, given at the right moment, can change the trajectory of a family’s life.

Michael is a Financial Planner at Totus Wealth Management and holds the Tax Planning Certified Professional® (TPCP®) designation. He works primarily with families, business owners, and real estate investors, focusing on proactive planning that integrates advanced tax strategies, retirement income decisions, and real-world wealth management. But his “why” goes far deeper than credentials or years in the business.

1 min read

Navigating Disruption and Market Contraction in Medicare Business in 2026 and Beyond

By NAIFA on 1/20/26 11:48 AM

NAIFA’s Medicare Collective will host "Navigating Disruption and Market Contraction in Medicare Business in 2026 and Beyond" as part of Medicare Collective Impact Day on Thursday, January 29, 2026, from 11:00 am to 2:00 pm Eastern. This free live virtual event for both NAIFA members and nonmembers brings together professionals who work directly in the Medicare market to discuss the real challenges that financial professionals are facing as the landscape continues to change.

1 min read

NAIFA's FSP Institute Elevates Professional Learning for Industry Practitioners

By NAIFA on 1/20/26 8:00 AM

February 17-20

Lake Nona Wave Hotel

Orlando, Fla.

The FSP Institute is an advanced planning experience designed for financial professionals looking to elevate their practices to new heights. It is a high-impact, collaborative event that features some of the leading experts as instructors facilitating conversations and sharing their knowledge and insights. Sessions will focus on such topics as advanced tax strategies, the impact of new legislation on college-funding strategies, financial ramifications of elder care, and many others all led by leaders in their fields. Register today.

2 min read

Karl Hansen — 50 Years of NAIFA Leadership, Integrity, and Advocacy

By NAIFA Membership on 1/9/26 3:33 PM

Karl Hansen, CLU, ChFC has been a NAIFA member for over 50 years, shaping both his career and the insurance industry through leadership, advocacy, and a steadfast commitment to integrity.

Born and raised in the Bay Area near Stanford University, Karl’s work ethic started early. He began working at just 14 years old, taking on everything from hauling to tree trimming while attending school at night. After a brief experience at the U.S. Coast Guard Academy, which was cut short by a broken leg, Karl returned home determined to build a future on his own terms.

2 min read

What’s Next for Medicare? Experts Weigh-In at NAIFA’s Impact Day

By NAIFA on 1/2/26 3:43 PM

On January 29, NAIFA’s Medicare Collective will bring together leading voices from across the Medicare ecosystem for focused, solutions-driven conversations about the forces reshaping the Medicare market. Sessions during this live virtual event will be hosted by members of the NAIFA Medicare Collective, seasoned professionals working on the front lines of Medicare.

3 min read

NAIFA Wishes Everyone a Happy and Prosperous New Year

By Kevin Mayeux on 1/1/26 10:00 AM

Like every new year, 2026 brings great promise and its fair share of challenges. At NAIFA, we look forward to building on our storied past while we make the most of a rapidly changing business environment (and support our members as they do the same). The insurance and financial service industry is not immune from forces reshaping our world, from the whirlwind of developments in technology to unpredictable economic situations to an ever-shifting legislative and regulatory landscape. NAIFA is on top of it, and we remain as committed as ever to fulfilling our membership promise: to advocate for positive legislative outcomes, educate agents and advisors, and help our members differentiate themselves in a competitive marketplace.

3 min read

Member Spotlight: Stephanie K. Triola, FSCP

By NAIFA Membership on 12/19/25 3:10 PM

Stephanie K. Triola, FSCP, has been a proud NAIFA member since 2023 and serves clients throughout Fernandina Beach, Florida, as a financial professional with New York Life Insurance Company and registered representative with NYLIFE Securities LLC. Her path into financial services was anything but predictable — and that’s exactly what makes her story so compelling.

2 min read

Why Future-Ready Planning Can’t Wait

By NAIFA on 12/17/25 3:35 PM

NAIFA's Carroll Golden recently shared a striking insight that should give every financial professional pause. According to new Pew Research, Americans are three times more likely to say they would prefer to live in the past rather than the future. Only 14% chose the future.

2 min read

Laura Mendoza – Helping Others Discover Their Potential

By NAIFA Membership on 12/12/25 3:44 PM

When Laura Mendoza moved from Northern California to attend the Fashion Institute of Design and Merchandising, she envisioned a career as a celebrity stylist in San Diego. But after graduation, opportunities in that field were limited. “Like many young professionals, I couldn’t find work in my realm,” Laura recalls. “I’m still a stylist on weekends, part-time—that’s kind of my side hustle.”

1 min read

FSP Institute 2026: 80 Years of Elevating Excellence

By NAIFA on 12/8/25 3:29 PM

The FSP Institute returns February 17–20, 2026, marking its 80th anniversary of bringing advanced financial planning experts together to push thinking forward and strengthen the profession. This milestone year will be hosted at the Lake Nona Wave Hotel in Orlando, Florida. Early registration is now open through January 3.

1 min read

Happy Thanksgiving From NAIFA

By Kevin Mayeux on 11/25/25 8:11 AM

With Thanksgiving, we naturally turn our attention to the three Fs: family, food, and football. But when we consider things that we are truly thankful for, I’d like to add one more: financial service professionals.

Americans have much to be thankful for this holiday season largely because of the crucial work you are doing. While your practice websites might tell us that you offer insurance products, financial planning, wealth management, or other products and services, what you are really giving your clients is peace of mind, opportunities to live their best lives, and happiness for themselves and their loved ones. These are among the things Americans are most thankful for.

1 min read

California Broker Spotlights Gilbert Mares: A Lifetime of Leadership Shaped by NAIFA

By NAIFA on 11/20/25 2:52 PM

Gilbert Mares, MPA, LUTCF, LILI, is profiled in the November issue of California Broker magazine, where he credits his decades of active service and leadership within NAIFA as the foundation of his professional success. In the feature, Mares explains that NAIFA has been central to every stage of his career, from his early days in the business to his longtime role as an educator, advocate, and mentor in the financial service community.

2 min read

Josh O’Gara Joins the NAIFA Board of Trustees

By NAIFA on 11/20/25 12:52 PM

National Association of Insurance and Financial Advisors (NAIFA) President Doug Massey, LUTCF, CLU, ChFC, CRES, FSS, has announced the appointment of Josh O’Gara, CLU, ChFC, CFP, a Partner and Co-Founder at Prism Benefits, PBC, in Woburn, Mass., to serve on the NAIFA Board of Trustees effective immediately.

5 min read

Give the Gift of Growth This Season: Earn Your LUTCF® at the Best Prices of the Year

By NAIFA on 11/19/25 4:06 PM

Give the Gift of Growth This Season: Earn Your LUTCF® at the Best Prices of the Year

2 min read

Planning Today for Tomorrow’s Care

By Kevin Mayeux on 11/17/25 4:32 PM

As we mark November, long-recognized as National Long-Term Care Awareness Month, I want to extend my thanks to the Tennessee Department of Commerce & Insurance for stepping forward with a public campaign to shine a spotlight on long-term care planning for the future. Their announcement reminds us that as Americans live longer lives, the possibility of needing long-term support services climbs significantly.

2 min read

Ellie Mills: Turning Life’s Trials into a Lifelong Mission to Protect Others

By NAIFA Membership on 11/13/25 9:07 AM

For more than three decades, Ellie Mills, ChFC, CLU, LUTCF, has built her career and reputation on compassion, resilience, and a steadfast commitment to helping others secure their financial futures. A loyal NAIFA member since 1992 and owner of Ellie Mills Insurance Agency, Inc. in Miami, Florida, Mills found her calling in the insurance industry through personal tragedy and triumph.

1 min read

Business Planning with Life and Disability Insurance

By NAIFA on 11/12/25 3:06 PM

Life and disability insurance are powerful tools in business planning, helping to protect companies, retain key employees, and facilitate ownership transitions. Join NAIFA on Wednesday, December 3, 2025, from 12:00 to 1:00 pm Eastern for “Business Planning with Life and Disability Insurance,” a program designed to help financial professionals strengthen their understanding of how these products support long-term business success.

1 min read

The Care Economy: Where Compassion Meets Capital

By NAIFA on 11/12/25 1:42 PM

Limited and Extended Care Planning (LECP) Collective Impact Day

Caregiving is not only a personal responsibility but an emerging economic force reshaping how advisors and agents approach financial planning, longevity, and multigenerational wealth. Join NAIFA’s Limited and Extended Care Planning (LECP) Collective for an engaging virtual Impact Day, “The Care Economy: Where Compassion Meets Capital,” on Wednesday, November 19, 2025, from 11:00 am to 1:30 pm Eastern.

38 min read

Navigating Economic Uncertainty and the Evolving Financial Services Industry With Jamie Hopkins

By Advisor Today on 11/10/25 1:28 PM

Jamie Hopkins is the Executive Vice President and Chief Wealth Officer at WSFS Bank, where he leads the wealth management segment, providing private wealth and trust services to clients through both WSFS Bank and Bryn Mawr Trust. Under Jamie's leadership, WSFS and its associated entities have served clients for over a century, and he has contributed to the financial services industry as an author, educator, and by helping launch over 700 FinServ Foundation fellowships for students.

45 min read

Building Industry Relationships and Elevating Advocacy in Financial Services With Brian Steiner

By Advisor Today on 11/10/25 1:26 PM

Brian Steiner is the Executive Director of Life Happens, where he is responsible for fostering partner relations and engagement at NAIFA. These organizations are committed to promoting financial literacy and supporting insurance and financial advisors. Under his leadership, Life Happens has successfully distributed over $4 million in scholarships and collaborates on the widely recognized research report, the Insurance Barometer. This partnership underscores its significant influence on both industry professionals and consumers alike.

1 min read

A Rare Opportunity: NAIFA Hosts Exclusive Interview with Top Advisor Mark Curtis

By NAIFA on 11/5/25 10:54 AM

NAIFA will present an exclusive live webinar featuring Mark Curtis, Managing Director at Morgan Stanley’s Graystone Consulting and one of the most consistently top-ranked financial advisors in the country (with estimated AUM at $490 billion).

3 min read

NAIFA Helps You Make the Most Out of Long-Term Care Awareness Month

By Kevin Mayeux on 11/3/25 6:00 PM

November is Long-Term Care Awareness Month and NAIFA is marking the occasion by spreading the word about caregiving and long-term care and providing financial professionals with valuable ideas and information. On November 19, NAIFA’s Limited and Extended Care Planning Collective is sponsoring an online event: “The Care Economy: Where Compassion Meets Capital.” It will feature seven 20-minute sessions by industry thought leaders who will share what advisors and agents need to know about the present and future of caregiving and long-term care. They will discuss such topics as the current state of long-term care insurance, the benefits of right-sizing LTC coverages, the role of annuity products in LTC planning, how to talk about LTC with younger clients, and much more.

1 min read

Extraordinary Estate Planning for Ordinary People

By NAIFA on 10/28/25 10:31 AM

Investment, Retirement, Estate and Advanced Planning (IREAP) Center Impact Day

Many Americans believe estate planning is only for the wealthy, but families of all income levels need a plan to protect their assets and loved ones. Misconceptions and confusion often prevent people from taking action, which can lead to costly consequences.

1 min read

The One Big Beautiful Bill; Several Big Beautiful(?) Tax Law Changes

By NAIFA on 10/28/25 10:29 AM

Recent tax law updates are reshaping the way financial professionals approach estate planning and charitable giving. Join NAIFA for “The One Big Beautiful Bill; Several Big Beautiful(?) Tax Law Changes” on Wednesday, November 12, 2025, from 3:00 to 4:00 pm Eastern for a clear overview of the key provisions introduced by this major legislation and what they mean for your clients.

3 min read

Billy Snyder: Building Trust and Community in Insurance

By NAIFA Membership on 10/27/25 10:22 PM

For nearly two decades, Billy Snyder, LACP, owner of B Snyder Insurance in Lafayette, Tennessee, has built his business and reputation on one guiding principle: “If you help enough people get what they want, you’ll get what you want.” That timeless Zig Ziglar philosophy has shaped every part of Billy’s journey—from his early days in pest control to becoming a respected independent insurance professional serving the rural communities of northern Tennessee.

38 min read

The Many Faces of Leadership and Building a Transformative Culture With John D. Richardson

By Advisor Today on 10/27/25 12:00 PM

John D. Richardson is a Financial Planner at Capital Planning Group, where he specializes in retirement planning, investment advice, and risk management for clients seeking to align their financial decisions with their values. As a recognized leader in the financial services industry, John has served as president of both NAIFA-Nashville and NAIFA-Tennessee, received the NAIFA Young Advisors Team Leader of the Year award, and was named a NAIFA Presidential Citation recipient, in addition to being elected NAIFA National Trustee for 2025-2026. Beyond his professional achievements, John is active in politics, serving as State Executive Committeeman for Senate District 21 in Tennessee and as a delegate to the Republican National Convention.

57 min read

Mentorship, Military Legacy, and Making a Difference With Susan Combs

By Advisor Today on 10/25/25 10:21 AM

Susan Combs is the Founder of Pancakes for Roger, a nonprofit that honors veterans and amplifies their stories through a grassroots “pancakes” movement. She created it after her father, a Major General, asked for pancakes while on hospice, inspiring a campaign, book, and advocacy project. Susan also leads Combs & Company, an insurance brokerage she launched at age 26, specializing in niche and non-traditional risks. She is a best-selling author and frequent speaker on mentorship, legacy, and service.

1 min read

Join Us for the Q4 2025 State of NAIFA Webinar

By NAIFA on 10/20/25 4:06 PM

NAIFA members are invited to the Q4 State of NAIFA webinar at 12 pm Eastern, October 22, 2025. Hear updates on NAIFA's advocacy efforts, professional development programs and other membership activities designed to enhance your professional growth. Every NAIFA leader should tune in.

2 min read

NAIFA and Connectiv Team up to Launch Protectors Vegas 2026

By NAIFA on 10/16/25 4:49 PM

NAIFA is reimagining its flagship event for 2026 with the launch of Protectors Vegas, a bold new experience created in partnership with Connectiv, the live-event studio known for producing InsureTech Connect, Medicarians, and other powerhouse industry gatherings. The event will take place November 9–11, 2026, at The Venetian in Las Vegas, bringing together top minds in insurance, financial advising, and annuities for an immersive, high-energy conference unlike anything the profession has seen. See coverage in InsuranceNewsNet and watch the video.

2 min read

O’Connell and Potts Are 2025 NAIFA Diversity Champions

By NAIFA on 10/13/25 10:47 AM

NAIFA is pleased to recognize two Diversity Champions for 2025: Danny O’Connell, LACP, of Dallas, Texas, and Christopher Potts, Sr., of Rock Hill, South Carolina. O’Connell and Potts will be honored along with other NAIFA award recipients at the 2025 Belong awards dinner on October 14 in Arlington, Virginia.

1 min read

NAIFA Takes Action to Protect Medicare Agents and Fair Compensation

By Kevin Mayeux on 10/10/25 4:56 PM

NAIFA is deeply concerned by company announcements indicating they no longer will pay commissions to Medicare agents. And today, Humana announced they will no longer use agents to sell Prescription Drug Plans (PDP). This alarming trend threatens not only the livelihood of financial professionals but also the millions of seniors who rely on them for help navigating their healthcare options. If you learn of other announcements, please forward them to communications@naifa.org.

3 min read

Limongelli, Owen, Porter, and Sayyad Named NAIFA’s Advisor Today 4 Under 40 Award Winners

By NAIFA on 10/9/25 1:58 PM

NAIFA’s Advisor Today is pleased to announce the winners of its annual 4 Under 40 awards: Nicholas Limongelli, CLU, of NAIFA-New York; S. Grayson Owen, CLU, REBC, of NAIFA-Georgia; Carson Porter, CFF, FSS, RICP, LUTCF, CHLU, of NAIFA-Nevada; and Rachel Sayyad of NAIFA-Maryland.

46 min read

Building Financial Security: Insights from Brandon Smith's Journey in Financial Services

By Advisor Today on 10/8/25 10:26 AM

Brandon Smith is an Executive Vice President at Milestone Financial Solutions, a firm that offers financial planning, investment, retirement, and estate-planning services to help clients reach key life goals. In his role, he provides comprehensive short-term and long-term financial and business planning catered to the needs of each client. His professional designations include CLU, ChFC, LUTCF, and CPFA. Before joining Milestone, Brandon began his career with AXA Advisors and later became a Registered Representative with The Leaders Group.

1 min read

Will AI transform or replace the estate planning industry?

By NAIFA on 10/6/25 4:59 PM

The Financial Times is inviting NAIFA members to attend (in person or virtually) its full-day conference, Guiding Generations: The Future of Estate Planning, presented by FT Live and Financial Advisor IQ in partnership with Trust & Will, taking place October 23, 2025, in New York and online. The event is free to all financial professionals. NAIFA is a supporting partner.

2 min read

Faith, Family, and Financial Planning: Meet New Member Matthew Crocker

By NAIFA Membership on 10/6/25 9:06 AM

For Matthew Crocker, founder of Crocker Financial LLC in Kent, Ohio, the financial services profession is more than a career—it’s a calling.

Matthew’s journey began in college, when a risk management class first opened his eyes to the world of insurance. Years later, that spark turned into a profession, inspired in part by personal experience. “Having had to rely on the GoFundMe method for a family member, I wanted to make sure others didn’t need to feel the same shame I did,” he shared. “This industry gives me the opportunity to make a visible difference in people’s lives, and that’s what attracted me most.”

1 min read

From the Journal of FSP: Financial Gerontology in Uncertain Times

By NAIFA on 9/26/25 12:05 PM

Uncertainty is not new, but for clients nearing or in retirement, financial volatility can create unique challenges. In his recent Journal of Financial Service Professionals article, John N. Migliaccio, PhD, RFG, FGSA, MEd, draws on lessons from past disruptions including the Great Recession and the COVID-19 pandemic to explore how advisors can help clients reframe risk and focus on what truly drives financial decision making.

3 min read

Study: Many Americans Are Sacrificing Retirement to Support Family Without Professional Guidance

By NAIFA on 9/26/25 12:01 PM

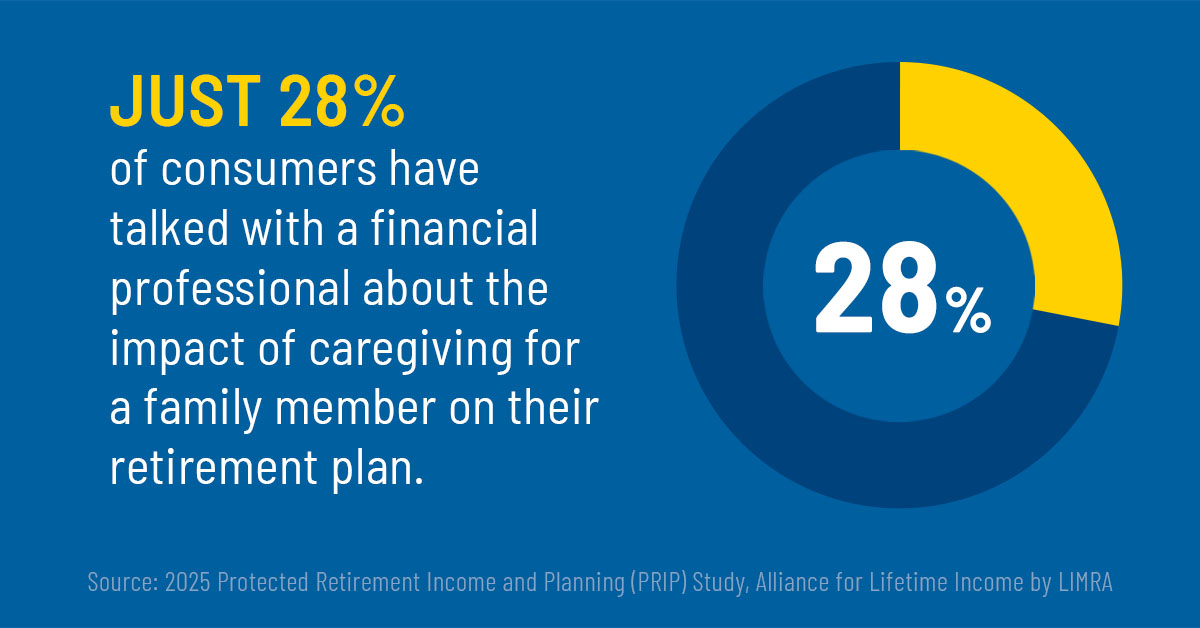

New findings from the Alliance for Lifetime Income’s 2025 Protected Retirement Income and Planning Study show that financial strain is leading many Americans to sacrifice their own retirement savings and economic well-being in order to support loved ones.

According to the study (now in its seventh year), nearly half of all consumers surveyed said they have made financial sacrifices for family members: 17% of consumers surveyed said they support adult children 26 and older; 10% support grandchildren and 7% support parents or in-laws. More than half say that their financial support affects their retirement savings.

Despite this, only 28 percent reported speaking with a financial professional about the impact on their long-term financial plans.

1 min read

From the Journal of FSP: The Social Security Fairness Act Is Now Law - What to Do

By NAIFA on 9/23/25 8:57 AM

The Social Security Fairness Act (SSFA), signed into law by President Biden in January 2025, eliminated two long-standing rules—the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These rules had reduced Social Security benefits for over 3 million public employees, like teachers, police officers, and other government workers, who also received pensions from jobs that didn’t pay into Social Security. WEP reduced their personal benefits, while GPO reduced spousal or survivor benefits. The repeal applies retroactively to benefits starting in January 2024. David G. Freitag, CLU, ChFC, CRPC, and Bruce A. Tannahill, JD, CPA, AEP, discuss the implications for financial professionals and their clients in the current issue of the Journal of Financial Service Professionals.

2 min read

Shane Westhoelter Is NAIFA’s 2025 Terry Headley Lifetime Defender

By NAIFA on 9/22/25 4:41 PM

NAIFA is proud to announce that Shane Westhoelter, AEP, CLU, LUTCF, LACP, the Founder and CEO of Gateway Financial Advisors, LLC., Gateway Insurance Group, Inc, and Gateway Insurance & Financial Services, LLC in Albuquerque, N.M., is the 2025 recipient of NAIFA’s Terry Headley Lifetime Defender Award.

2 min read

Calling All NAIFA Leaders: Join Me at the NLC!

By Christopher Gandy, LACP on 9/22/25 4:08 PM

When I first stepped into a leadership role at NAIFA, I did it as a volunteer. What I didn’t realize at the time was how rewarding, energizing, and impactful the experience would be. Serving as a volunteer leader has not only been gratifying on a personal level, it has also been one of the best investments I’ve made in my career, my leadership skills, and my ability to serve our profession.

2 min read

Care for a Lifetime: Long-Term Protection in the Face of Alzheimer’s and Dementia

By NAIFA on 9/17/25 1:52 PM

Cognitive decline is one of the greatest challenges individuals and families may face, with conditions like Alzheimer’s and dementia bringing lasting impacts on health, finances, and caregiving. For financial professionals, understanding the role of lifetime long-term care coverage is essential to guiding clients through this difficult journey.

1 min read

Five Overlooked Data Sources for Smarter Small Business Decisions

By NAIFA on 9/16/25 9:14 AM

Small business owners often make critical decisions based on instinct or short-term needs, while larger companies lean on dedicated data analysis teams. Yet, as Kevin Tacchino, MSTFP, points out in his recent Journal of Financial Service Professionals article, even the smallest businesses are quietly collecting valuable data through their websites, sales systems, inventory tools, and customer relationships. The challenge is not in gathering the data, it’s in using it wisely.

3 min read

The Miracle of Life Insurance

By Ike Trotter on 9/16/25 9:03 AM

To help NAIFA celebrate Life Insurance Awareness Month, a dedicated NAIFA member since 1975 share how the life insurance business has changed over his career.

2 min read

CFS’ Legacy of Giving: $2.1 Million Raised for Make-A-Wish and Counting

By NAIFA Membership on 9/15/25 8:48 AM

Certified Financial Services (CFS), a proud NAIFA Financial Security Champion, is dedicated to helping individuals, families, and small business owners pursue lasting financial security. While the world is constantly changing, CFS believes in the lasting power of relationships and community. The firm understands that each person they serve has goals—some financial, others personal—but at the heart of every plan is a focus on the people who matter most. That same people-first mindset is what fuels the firm’s long-standing commitment to giving back.

2 min read

NAIFA-Texas President Rick Demko to Be Honored as YAT Leader of the Year

By NAIFA on 9/10/25 9:31 AM

The National Association of Insurance and Financial Advisors (NAIFA) is thrilled to announce that Richard “Rick” Demko, CLU, ChFC, RICP, AEP, LUTCF, LACP, has been named the 2025 Young Advisor Team Leader of the Year. This award celebrates outstanding leadership, dedication, and impact within the financial advisory industry, recognizing individuals who exemplify the highest standards of excellence.

2 min read

André M. Williams — From Second Chances to Lasting Impact

By NAIFA Membership on 9/7/25 9:02 AM

André M. Williams’ path into the insurance and financial services industry began with a lesson in resilience. As a freshman at Ohio University, he started out on track to become a CPA—but a little too much fun and not enough discipline led to an academic dismissal. A stern two-hour call from his mother, an 8-page letter to the Dean, and a heartfelt plan for the future earned him a second chance.

4 min read

Trusting Vibes or Planning Ahead? How Americans Make Life’s Biggest Decisions

By NAIFA on 9/4/25 12:42 PM

Gut feelings, prayers, and even “pure vibes” are shaping some of the most important decisions in Americans’ lives. That’s the eye-opening takeaway from a new Life Happens survey conducted by Talker Research for Life Insurance Awareness Month and recently featured in both the National Enquirer and the New York Post.

2 min read

September Kicks Off Life Insurance Awareness Month

By Kevin Mayeux on 9/1/25 8:36 AM

As a proud Florida Gator, September brings me all the anticipation, hope, and excitement of a brand-new college football season. As the CEO of the oldest and most influential association for insurance and financial professionals in the United States, it brings me the pride and heightened sense of purpose of Life Insurance Awareness Month.

LIAM was created and continues to be coordinated by Life Happens, a NAIFA community. It is a time when we shine a spotlight on the importance of life insurance products and educate consumers about this foundation of many comprehensive financial plans. Financial professionals understand that life insurance provides vital protection to more than 80 million American households (even if many are underinsured) and that coverage is available to fit the budgets of families at most income levels.

7 min read

The Birthday Rule: Is It in Your State and What It Means for Agents and Med Supp Clients

By Senior Market Sales on 8/27/25 2:42 PM

This content is brought to you by NAIFA's Medicare Collective.

Birthday rule legislation was introduced to address a significant gap in the Medicare Supplement (Med Supp) policy market. Traditionally, Medicare Advantage clients have the opportunity to shop and switch plans annually during the open enrollment period starting October 15 and running through December 7. However, this flexibility was not available to Med Supp policyholders, putting them at a disadvantage as they aged and their health potentially deteriorated.

To mitigate this issue, certain states have enacted the birthday rule. This legislation allows Med Supp policy owners the opportunity to shop for plans that better suit their needs and budget, without the fear of being declined due to health reasons. Essentially, it aims to provide a level playing field, ensuring that Med Supp policyholders can also benefit from competitive rates.

2 min read

Why did you choose a career in life insurance?

By Kevin Mayeux on 8/19/25 4:31 PM

The life insurance profession is facing a pivotal moment. Over the next 10 years, more than 110,000 financial professionals are expected to retire. That represents about 38% of the industry’s workforce and over 41% of the assets they manage.

2 min read

The Fortis Agency Sets the Standard: NAIFA’s First Dual 100% Agency

By NAIFA Membership on 8/19/25 11:25 AM

The Fortis Agency has once again raised the bar — becoming NAIFA’s first-ever Dual 100% Agency with every member participating in both NAIFA membership and NAIFA’s network of PACs (Political Action Committees). This landmark accomplishment represents more than full engagement — it’s a bold statement of what it means to lead with purpose.

1 min read

Charitable Planning in 2025

By NAIFA on 8/18/25 11:22 AM

Significant changes to charitable giving rules are on the horizon, and now is the time for your clients to prepare. The OBBBA introduces new rules taking effect on January 1, 2026, with several opportunities set to expire on December 31. Acting now can help clients maximize available benefits and avoid missed opportunities.

2 min read

Financial ConNEXTion is unique educational and networking event at sea

By NAIFA on 8/14/25 1:31 PM

NAIFA is pleased to extend an invitation to the 2026 Financial ConNEXTion cruise conference, an experience that goes beyond professional development and taps into the future of our industry. Created by the Society of Financial Service Professionals (FSP) with NAIFA continuing the legacy, this initiative is designed to build bridges between NEXTGen talent and the financial services community.

1 min read

Q2 IFAPAC Hard Hat Award: Advancing the Profession with Mike LaPorte

By NAIFA Membership on 8/13/25 3:46 PM

NAIFA is proud to recognize Mike LaPorte as the recipient of the Q2 IFAPAC Hard Hat Award, honoring his outstanding commitment to NAIFA’s advocacy mission and his tireless support for the Insurance and Financial Advisors Political Action Committee (IFAPAC).

4 min read

Five NAIFA Legends to Be Honored as Hall of Fame Inductees

By NAIFA on 8/13/25 12:54 PM

NAIFA is pleased to announce five new inductees into the NAIFA Hall of Fame. The NAIFA Board of Trustees authorized the creation of the Hall of Fame last year to recognize and celebrate members whose extraordinary service and contributions represent the legacy of the most accomplished, impactful, and inspirational members of the NAIFA family.

The 2025 NAIFA Hall of Fame Inductees are:

- Peter C. Browne, LUTCF*

- Ben Feldman*

- Terry K. Headley, LUTCF, FSS, LIC*

- Robert M. Nelson, CLU, LUTCF, FSS

- Lester A. Rosen*

1 min read

Q2 Hard Hat Award for Membership: Scott Blake — Building Connections That Last

By NAIFA Membership on 8/11/25 8:26 AM

NAIFA is proud to recognize Scott Blake, MBA, ChFC, CLU, as our Q2 Hard Hat Award winner for his outstanding, all-around contributions to membership growth, engagement, and leadership. Scott serves as Assistant Vice Chair on NAIFA’s National Membership Committee and is a dedicated leader at both the state and local levels in Ohio.

1 min read

NAIFA Past President Mark Johnson Has Passed Away

By NAIFA on 8/8/25 4:03 PM

With great sadness, we share the news that NAIFA Past President Mark D. Johnson, CLU, RHU, ChFC, passed away on July 28. He served as President of NAIFA (then known as NALU) during the 1997-1998 association year and was the Chair of Life Happens (then, the Life and Health Insurance Foundation for Education) in 2006. While a member of NAIFA’s Board of Trustees in the mid-1990s, he led an important Strategic Planning Task Force that shaped the association’s direction for many years to follow. After his term as President, Mark continued as a volunteer leader providing guidance for NAIFA’s Advisor Today magazine. Prior to his national leadership, Mark was President of NAIFA-Minnesota and NAIFA-Lake Superior.

4 min read

NAIFA Announces Candidates Nominated for 2026 National Leadership Roles

By NAIFA on 8/7/25 10:22 AM

NAIFA’s Committee on Governance has nominated Carina Hatfield, LUTCF, CLCS, LACP, agency owner of Weigner Insurance & Financial Services, Inc. in Pottstown, Penn., to be the 2026 NAIFA Secretary. Hatfield, who currently serves on the Life Happens Council and NAIFA’s National Membership Committee and Government Relations Committee, is a NAIFA-National Trustee and Past President of NAIFA-Pennsylvania. She has been a NAIFA member since 2005. As incoming Secretary, Hatfield will be in line to serve as President-Elect in 2027 and President in 2028.

43 min read

Building a Purpose Driven Financial Practice With Craig Wright

By Advisor Today on 8/6/25 12:03 PM

Craig Wright is a financial advisor with Certified Financial Planner (CFP) and Chartered Financial Consultant (ChFC) designations. He served as the NAIFA Missouri president and is a founding partner of a financial services firm with over 15 years of experience offering fee‑based financial and insurance planning to individuals, families, and small businesses. Craig holds a MBA from Southwest Baptist University.

3 min read

Q2 Hard Hat Award for Grassroots- Marc Sigmon: Building Influence from the Ground Up

By NAIFA Membership on 8/4/25 3:31 PM

Please join us in congratulating Marc Sigmon, our Q2 Hard Hat Award winner in the Grassroots category! Grassroots advocacy is the heartbeat of NAIFA's impact, and Marc embodies that mission with every step he takes through the halls of Congress.

A dedicated leader, proud veteran, and unwavering industry advocate, Marc has been named NAIFA’s Q2 Hard Hat Award winner in the Grassroots category. This honor recognizes his exceptional commitment to engaging lawmakers, mobilizing local members, and ensuring the voices of agents and advisors are heard at every level of government.

4 min read

Getting Your Clients Ready for the Medicare Annual Enrollment Period

By Elie Harriett on 8/1/25 3:46 PM

There are a lot of things you have to do to prepare your practice for the Medicare Annual Enrollment Period. A lot of it is work in the office behind the scenes. But some of it is client preparation. Our older clients by now have a better idea of the schedule, but newer ones need some training.

Why is preparing clients important for this period? Simply put, if you do not prepare your clients, I can guarantee someone else will. There are too many other agents and brokers selling Medicare products for your clients not to be solicited by them. And even for the ones you don’t expect to leave, the advertising, temptation, and word of mouth among friends and neighbors may be too great for some of them. It does not take a lot of effort to just remind your clients that you are here, you know what’s coming, and you have their back. Most of the time that is all you need to do to retain their business. Here is what we do to prepare our clients.

August:

4 min read

NAIFA Past President Robert Miller to Receive the Life Insurance Industry’s Highest Honor

By NAIFA on 8/1/25 8:38 AM

Robert A. Miller, M.S., M.A., of New York City and Vero Beach, Florida, a retired Managing Partner at Miller-Pomerantz Insurance and Financial Services in New York City and NAIFA Past President, has been selected as the 2025 John Newton Russell Memorial Award recipient. The award is the highest honor accorded by the insurance industry to a living individual who has rendered outstanding services to the institution of life insurance. Miller will be celebrated and formally presented the award at NAIFA’s Belong Dinner, October 14 in Arlington, Virginia.

1 min read

Leading the Charge in Medicare Advocacy: Meet Dwane McFerrin

By NAIFA Membership on 7/30/25 10:00 AM

Dwane McFerrin has spent decades navigating the complexities of Medicare policy and product development and he understands just how disruptive regulatory changes can be for the professionals who support seniors every day. That’s one reason he became a founding member of NAIFA’s Medicare Collective, a new initiative created to empower professionals working in Medicare and healthcare solutions through advocacy, education, and community.

55 min read

Adapting to Change and Leading Through Decades of Financial Evolution With John Davidson

By Advisor Today on 7/29/25 3:00 PM

John Davidson is a Life Underwriter Training Council Fellow and Financial Services Specialist serving a diverse client base, including municipalities, private schools, and public corporations. A long‑time leader in his profession, John is a certified Financial Security Advocate and has served in top roles within NAIFA, including National President in 2006-07.

3 min read

Planning for a 9, Not Just a 3: A Personal Take on Life Insurance

By Midland National® Life Insurance Company on 7/25/25 3:30 PM

This content is brought to you by NAIFA's Investment, Retirement, Estate and Advanced Planning Center.

Ask your clients to rate the life they’re living on a scale from 1 to 10.

Their car? An 8 or 9.

Their home? Maybe a 7 or 8.

Their kids’ school? An 8, maybe higher.

Your clients work hard to provide a life they’re proud of. But when it comes to protecting that lifestyle, too many are only planning for a 3. To me, that’s a disconnect. If your clients are working hard to give their families the best, why would the plan to protect it fall short?

1 min read

Kevin Mayeux Highlights Importance of Private-Sector Retirement Solutions

By NAIFA on 7/25/25 9:30 AM

As more states launch automatic retirement savings programs for private-sector workers, the national conversation around retirement readiness is growing. A recent article in Stateline explores how states like Nevada and Colorado are addressing this issue through auto-IRA programs designed to reach workers without access to employer-sponsored plans.

1 min read

“Mother Medicare”: Jane Ahrens Brings Her Voice—and a Movement—to NAIFA’s Medicare Collective

By NAIFA Membership on 7/24/25 11:00 AM

When Jane Ahrens transitioned from a 25-year career teaching Health Education to working in Medicare sales, she didn’t just start a new chapter—she found her calling. What began in 2008 as a solo effort to help clients understand their health insurance options has since grown into a thriving business with a team of more than 160 independent agents trained and mentored under her leadership. Her peers now affectionately call her “Mother Medicare.”

34 min read

Expanding the Reach of Fraternal Benefit Societies Through Technology and Advocacy With Kate Shafer

By Advisor Today on 7/23/25 1:45 PM

Kate Shafer is the Director of Member Engagement & Communications at the American Fraternal Alliance, a nonprofit that supports fraternal benefit societies across the US and Canada by offering advocacy, education, and financial services to over seven million members. In her role, she leads initiatives to enhance member engagement, communications, and programming across the Alliance’s network. Kate plays a key part in organizing signature events like the Spring Symposium, which focuses on member engagement, digital transformation, and governance.

1 min read

Long-Term Care Insurance is a Critical Part of the Caregiving Conversation

By Carroll Golden on 7/21/25 3:46 PM

I was encouraged to see NAIFA CEO Kevin Mayeux’s recent column in InsuranceNewsNet spotlighting two critical legislative initiatives that NAIFA strongly supports: the Credit for Caring Act and the Lowering Costs for Caregivers Act. These proposals aim to provide meaningful tax relief and expanded savings tools for caregiving families—support that’s urgently needed as more baby boomers reach their 60s and the demand for long-term care solutions continues to rise.

6 min read

Getting Your Practice Ready for the Annual Enrollment Period

By Elie Harriett on 7/21/25 2:46 PM

Because of the special circumstances demanded of us during the annual enrollment period, it takes us months to prepare for what is essentially a 68-day selling season. We are basically a normal health insurance office from January until June, and then beginning in July we start getting ready for October 1, the date we can begin speaking with clients new and old about their health plans for the following year. Here is what our office does:

2 min read

NAIFA CEO Kevin Mayeux Highlights the Financial Strain of Caregiving

By NAIFA on 7/17/25 2:38 PM

NAIFA CEO Kevin Mayeux’s latest column, The Bipartisan Kindness of Caregiving, is featured in InsuranceNewsNet. In this piece, Kevin brings national attention to the financial burden faced by millions of Americans who care for aging parents and loved ones. His message is clear: Caregiving is both an act of love and a financial challenge that deserves bipartisan legislative support.

3 min read

Melinda “Lindy” Camardella’s Journey of Resilience, Advocacy, and Service

By NAIFA Membership on 7/16/25 10:59 AM

Melinda “Lindy” Camardella’s path to the financial services industry—and to her current role as a Financial Advisor with Equitable Advisors—was shaped by personal strength, a deep sense of purpose, and an unwavering commitment to helping others. A licensed acupuncturist and longtime advocate for her profession, Lindy made the shift to financial services after a life-changing health challenge gave her a new perspective.

1 min read

Your Commitment Deserves Recognition: Apply for NAIFA’s National Quality Award

By NAIFA on 7/14/25 3:43 PM

Call for Nominees: 2025 NAIFA National Quality Award

Application Deadline: July 31, 2025

2 min read

Social Security Unlocked: Maximizing Benefits & Guiding Your Clients

By NAIFA on 7/14/25 11:43 AM

Social Security remains one of the most important and often misunderstood components of retirement income planning. For financial professionals, helping clients navigate the complex claiming rules and optimize their benefits can make a meaningful difference in their long-term financial security.

Join us on Wednesday, August 6, 2025, from 12:00 to 1:00 pm Eastern for a webinar with Martha Shedden, RSSA, CRPC, President and Co-founder of the National Association of Registered Social Security Analysts. This webinar is free for both members and non-members, thanks to co-sponsorship by RSSA.

50 min read

Leadership, Endurance, and Ice Cream With Chris Gandy, Carina Hatfield, Kathleen Owings

By Advisor Today on 7/10/25 2:19 PM

Chris Gandy is the Founder of Midwest Legacy Group LLC, a boutique concierge insurance group for executives, professional athletes, physicians, business owners, and entrepreneurs. It focuses on the client's interests in wealth accumulation, wealth preservation, retirement strategies, insurance, asset protection, and investments. He previously worked as a Representative for Northwestern Mutual Financial Network, the APEX Consulting Group LLC, and was the Senior Vice President of Sales at MassMutual Chicago.

Carina Hatfield is a Life Underwriting Training Council Fellow (LUTCF), Commercial Lines Coverage Specialist (CLCS), and Life and Annuity Certified Professional (LACP). As a third-generation insurance agent, she specializes in property and casualty insurance and works with locally owned businesses. Carina serves NAIFA as a National Trustee and a moderator for Pennsylvania’s Leadership in Life Institute. She is also the immediate past President of NAIFA Pennsylvania. Recently, Carina helped develop the organization’s new online LACP prep course.

Kathleen Owings is the Principal and Financial Advisor of Westbilt Financial Group, an independent financial advisory firm providing comprehensive planning for clients wanting to achieve personal goals. Graduating from the US Military Academy at West Point in 2000, Kathleen served for eight years as an active duty officer in the Army Corp of Engineers. In 2007, she began her career in the financial services industry, obtaining licensure in life and health insurance and maintaining Series 6, 7, 63, and 65 securities registrations. Kathleen’s book, Put Your Money to Work: A Woman's Guide to Financial Confidence, helps women take control of their finances.

NJBiz Opinion Column from NAIFA Trustee: Keep NJ insurance agents independent

By NAIFA on 7/7/25 2:18 PM

In his column published in both the print and digital editions of NJBiz, NAIFA national Trustee Dennis Cuccinelli, a member of NAIFA-New Jersey, warns that the state's proposed reclassification of insurance agents as employees instead of independent contractors would limit agents' independence, reduce consumer choice and potentially harm families' access to financial protection.

3 min read

Member Spotlight: Eric K. Williams - Empowerment Through Education and Advocacy

By NAIFA Membership on 7/3/25 12:25 PM

Eric K. Williams, founder of Empowerment Resources International Corp in Chicago, Illinois, didn’t plan on entering the financial services industry. In fact, he was first introduced to it through a simple question: “Could you save $200 a month?” That question led him to a presentation about insurance and annuity products—and sparked a realization. “I had left corporate America and didn’t have a structured way to save for retirement,” he recalls. Inspired by what he learned, Eric got licensed and officially entered the industry in January 2005.

3 min read

From Art Room to Boardroom: The Journey of Maureen Kirschhofer

By Zack Huels on 7/1/25 8:00 AM

When you meet Maureen Kirschhofer, you quickly realize you're speaking with someone whose life has been marked by reinvention, resilience, and remarkable leadership. From her early days as an art teacher to becoming a trailblazing manager in the insurance industry, Maureen’s story is as colorful and compelling as one of her paintings.

42 min read

How Financial Advisors Can Stand Out: Marketing Strategies With Ryan Ross

By Advisor Today on 6/30/25 3:54 PM

Ryan Ross is a seasoned marketing professional helping independent financial advisors grow their businesses through strategic content, SEO, and digital automation. With a background in financial services and marketing technology, he brings a unique perspective on how advisors can effectively build their online presence. Ryan is passionate about equipping financial professionals with the tools and strategies they need to stand out in a competitive marketplace. Outside of work, he enjoys endurance sports and has completed multiple triathlons, including several IRONMAN races.

39 min read

Balancing Life, Leadership, and Wellness With Carina Hatfield

By Advisor Today on 6/27/25 11:05 AM

Carina Hatfield is a Life Underwriting Training Council Fellow, Commercial Lines Coverage Specialist, and Life and Annuity Certified Professional. As a third-generation insurance agent, she specializes in property and casualty insurance and works with locally owned businesses. Carina serves NAIFA as a National Trustee and a moderator for Pennsylvania’s Leadership in Life Institute. She is also the immediate past President of NAIFA Pennsylvania. Recently, Carina helped develop the organization’s new online LACP prep course. Her passion and dedication to the association earned her the 2020 Young Advisor Team Leader of the Year Award.

4 min read

The Importance of Future Income

By Ike Trotter on 6/23/25 2:30 PM

“Future income means income to make tomorrow the kind of a tomorrow we want it to be”

1 min read

Happy 135th Birthday, NAIFA!

By Kevin Mayeux on 6/18/25 2:20 PM

On this day in 1890, a group of forward-thinking professionals gathered in Boston with a bold vision: to elevate the profession, advocate for consumers, and set a standard of excellence for financial advisors. That vision became NAIFA and 135 years later, it’s still going strong.

2 min read

Twelve Students Receive Paul S. Mills Scholarship Awards

By NAIFA on 6/18/25 9:16 AM

NAIFA is pleased to announce the 2025 recipients of the Foundation for Financial Service Professionals’ Paul S. Mills Scholarships and the inaugural Eileen J. Prus and Edmund O. Ciske Jr.-designated Paul S. Mills Scholarship. This annual program provides need-based scholarships to students pursuing degrees in financial service-related fields. Each of the 12 recipients receives a $1,000 scholarship.

37 min read

Building Legislative Bridges in Financial Services With Diane Boyle

By Advisor Today on 6/17/25 3:03 PM

For over 30 years, Diane Boyle has been the Senior Vice President of Government Relations for NAIFA. Diane advocates for state, interstate, and federal laws that benefit the good of the people. She graduated from Louisiana State University with a degree in political science and government.

2 min read

Attorney and Industry Thought Leader Kathleen Bilderback Joins the NAIFA Board of Trustees

By NAIFA on 6/16/25 2:49 PM

NAIFA President Doug Massey, LUTCF, CLU, ChFC, CRES, FSS, has announced the appointment of Kathleen Bilderback, Counsel in the Business Practice Group with Sandberg, Phoenix & von Gontard P.C., to serve on the NAIFA Board of Trustees.

4 min read

Considering Medicare Costs in Retirement Planning: What Financial Professionals Need to Know

By Elie Harriett on 6/13/25 9:30 AM

For many Americans, reaching Medicare eligibility marks a noticeable decrease in healthcare spending. Of course, that doesn’t mean that Medicare is free. For financial advisors helping clients prepare for retirement, understanding and planning for the costs associated with Medicare is critical. While these costs are often lower than those incurred through pre-65 health insurance, they remain significant, especially when viewed over a multi-decade retirement.

3 min read

Dan Peterson of E4 Insurance Services Appointed to NAIFA Industry Leadership Board

By NAIFA on 6/12/25 2:18 PM

The National Association of Insurance and Financial Advisors (NAIFA) has appointed Dan Peterson, LLIF, LUTCF, FIC, President and Managing Partner for E4 Insurance Services, to the Industry Leadership Board (ILB).

3 min read

Member Spotlight: Wayne McCullough — Celebrating 50 Years of Purpose, Perseverance, and Professionalism

By NAIFA Membership on 6/11/25 7:39 PM

Wayne McCullough didn’t plan on spending five decades in the insurance and financial services industry. In fact, he thought it would be a quick stop on his way back to college. But what began as a six-month detour became a lifelong career—one rich with relationships, professional growth, and meaningful impact.

1 min read

The Holy Grail of Income Planning

By NAIFA on 6/10/25 10:38 AM

When it comes to retirement planning, financial expertise alone isn’t enough. Today’s clients are looking for more than just numbers. They want guidance that speaks to their goals, fears, and vision for the future. Building trust and addressing the emotional side of retirement decisions can be just as important as crafting tax-efficient strategies.

44 min read

Marketing Tips for Financial Advisors With Grace Staten

By Advisor Today on 6/9/25 2:35 PM

Grace Staten is a seasoned marketing executive with over 25 years of experience in the financial services industry. She has led comprehensive initiatives in branding, digital strategy, public relations, and advisor development, significantly enhancing organizational growth and visibility. Grace holds a MBA in finance from San Jose State University, FSCP designation, and multiple FINRA licenses. A passionate advocate for women in finance, she serves as National President of the Accounting and Financial Women’s Alliance and was named a Top 50 Woman Leader in Finance for 2025 by Women We Admire.

1 min read

Upcoming State of NAIFA to Feature Massey, Mayeux, and Boyle

By NAIFA on 6/9/25 11:41 AM

NAIFA members, mark your calendars for June 26th at 12 pm Eastern for the Q3 State of NAIFA webinar. Learn about the latest on NAIFA’s progress, advocacy efforts, and how you can get the most out of your membership.

39 min read

Leadership, Legacy, and Women in Financial Services With Juli McNeely

By Advisor Today on 6/4/25 3:14 PM

Juli McNeely, CFP, CLU, LUTCF, is a seasoned financial services professional with over 25 years of experience. Through her consulting work and speaking engagements, she continues to empower financial professionals to define success on their own terms and excel in their careers. In 2014, Juli made history as the first female president of NAIFA. She is also the accomplished author of No Necktie Needed: A Woman’s Guide to Success in Financial Services, which offers insights into achieving a balanced and fulfilling career in the industry.

2 min read

Q1 2025 Hard Hat Award – Grassroots Champion: Brian Fleming, NAIFA-MN

By NAIFA Membership on 5/30/25 2:50 PM

The NAIFA National Grassroots Committee proudly recognizes Brian Fleming of NAIFA-Minnesota as the recipient of the Q1 2025 Hard Hat Award for his exceptional advocacy leadership and unwavering dedication to our industry.

Brian played a pivotal role in organizing NAIFA-MN’s grassroots mobilization during the early fight against House File 2437, legislation that proposed a sales tax on a range of professional services—including financial planning, insurance commissions, legal services, and even CPA services.

2 min read

Q1 2025 Hard Hat Award – Membership Champion: Paul Szkotak

By NAIFA Membership on 5/30/25 2:49 PM

Please join us in congratulating Paul Szkotak, our Q1 Hard Hat Award winner in the Membership category!

As a dedicated member of the National Membership Committee, Paul has invested countless hours into enhancing NAIFA’s new member onboarding experience. His thoughtful input and strategic vision have laid the groundwork for a refreshed and more impactful welcome process—one that ensures new members feel connected, informed, and valued from day one.

3 min read

Q1 2025 Hard Hat Award – PAC Champion: Joseph Orr

By NAIFA Membership on 5/30/25 2:48 PM

NAIFA is proud to recognize Joseph Orr of NAIFA-Texas as the Q1 recipient of the Hard Hat Award in the PAC category - an honor reserved for outstanding champions of political advocacy. Known for his magnetic leadership and heartfelt commitment to NAIFA’s mission, Joseph was instrumental in the success of the NAIFA-TX Centennial Celebration, helping drive over $12,000 in PAC contributions.

4 min read

Boost Productivity and Sales: How Life Insurance Agents and Financial Advisors Can Leverage Software and AI

By Ken Leibow on 5/30/25 9:43 AM

In today's competitive financial services environment, technology isn't just a support tool—it’s a strategic advantage. Life insurance agents and financial advisors who integrate the right software solutions into their workflow not only save time, but also significantly increase client engagement, retention, and revenue.

2 min read

Member Spotlight: John Duni, Financial Advisor Celebrating 50 Years of Leadership, Legacy, and Loyalty

By NAIFA Membership on 5/29/25 10:16 AM

When John Duni walked into his first job out of college on November 4, 1974, he had no idea it would be the start of a 50-year career in financial services—and a lifelong commitment to NAIFA.

Hired by Harold Morris at Southwestern Life Insurance Company in Washington, D.C., John recalls that joining NAIFA (then NALU) was not just encouraged—it was expected. “You’d sign your agent contract and then your NAIFA application. There was no choice. But I always thought that was great. If I was going to commit to the profession, I wanted to be fully in it.”

1 min read

Creative Charitable Planning with Non-Cash Assets: A Case Study Approach

By NAIFA on 5/28/25 10:52 AM

Non-cash assets such as real estate, closely held business interests, and collectibles represent a massive and largely untapped opportunity in charitable giving. While these assets are estimated to total between $40 and $60 trillion in value, they make up less than 2% of all charitable donations. For financial professionals working with affluent clients, understanding how to leverage these assets is essential to providing effective tax and philanthropic planning strategies.

43 min read

Embracing Change, AI, and Strategic Acquisitions in Finance With David Wood

By Advisor Today on 5/27/25 9:42 AM

David Wood is a seasoned financial services professional with nearly four decades of industry experience. He began his career in 1986, navigating early challenges like the 1987 market crash, which shaped his resilient approach to financial advising. Together with his firm, David has been empowering independent financial advisors through strategic support, innovative growth solutions, and client-centric strategies. Beyond his professional endeavors, he is actively involved in industry advocacy and mentorship, contributing to the advancement and education within the financial advisory community.

3 min read

Making a Difference Every Day: Mark Anderson on a Life in Financial Services

By Zack Huels on 5/26/25 10:30 AM

In a career that has spanned nearly four decades, Mark Anderson has experienced the financial services industry from multiple angles—advisor, mentor, advocate, and leader. His journey, which began just days after graduating from Brigham Young University with a degree in economics, has been one of steady commitment, continuous evolution, and above all, purpose.

2 min read

Member Spotlight: Brandon Chambers, LUTCF – A Purpose-Driven Career

By NAIFA Membership on 5/19/25 10:36 AM

Brandon Chambers didn’t follow a traditional path into the financial services industry. After several years working in the chemical field with long, irregular hours, he began seeking a career that offered more purpose and better work-life balance. A call from a longtime friend—now his general agent—reignited a conversation about joining the Knights of Columbus as a field agent. With a leap of faith and a desire to serve others more meaningfully, Brandon entered the profession in 2017 and hasn’t looked back.

38 min read

Navigating Uncertainty With Life Insurance Featuring Bobby Johnson and Joel Tabin

By Advisor Today on 5/13/25 4:26 PM

Bobby Johnson is an experienced general agent and sales and distribution executive in the financial services industry. He leads life insurance distribution strategies, focusing on expanding agent partnerships and enhancing customer experiences. Bobby's commitment to collaboration and innovation is evident in his active involvement in initiatives that benefit both agents and clients alike.

Joel Tabin is a Chartered Life Underwriter, a Chartered Financial Consultant, and an Accredited Estate Planner. Focusing on empowering independent financial professionals, he assists advisors in integrating life insurance into their practices as a vital component of comprehensive financial planning. Joel is recognized for his commitment to advisor development, regularly leading training sessions and celebrating agent achievements. His leadership emphasizes the importance of life insurance in financial strategies, aiming to enhance client outcomes and advisor success.

1 min read

Member Spotlight: Melvin L. Pope III – Nearly 50 Years of Advocacy, Service, and Purpose

By NAIFA Membership on 5/12/25 10:36 PM

Melvin L. Pope III, of Tallahassee, Florida, is a loyal NAIFA member since 1979. He has built a long-standing relationship with the association and a career dedicated to serving others through thoughtful financial planning and advocacy.

Melvin now leads Financial Partners, where his passion lies in the design of comprehensive benefit plans, including medical, dental, disability, and life insurance. What first attracted him to the profession—and continues to inspire him today—is the independence it provides and the ability to craft meaningful, complex financial solutions that change lives. Helping people protect and achieve their financial goals has been a constant motivation throughout his career.

2 min read

The Rise of Cash Balance Plans: Why They’re Here to Stay

By NAIFA on 5/12/25 3:12 PM

Cash balance plans have quickly become one of the most popular options in the defined benefit space—now representing over 50% of all such plans. Their appeal lies in their flexibility, tax advantages, and ability to help small business owners save more for retirement while reducing taxable income. As more clients look for impactful retirement planning strategies, understanding how cash balance plans work is more important than ever.

Join us on Wednesday, May 28, 2025, from 12:00 to 1:00 pm Eastern for an in-depth webinar exploring the growing popularity of cash balance plans and how they can be leveraged to serve clients' retirement and tax planning goals.

This session will cover:

-

How to layer a cash balance plan on top of an existing retirement plan.

-

The role of life insurance in enhancing cash balance plan benefits.

-

Tax advantages unique to this type of plan.

-

Why these plans are a practical solution even for businesses with multiple employees.

Armando Testani, Retirement Services Consultant at Security Mutual Life Insurance Company, will lead the presentation. With more than two decades of experience in qualified and non-qualified plan strategies, Armando will share valuable insights and practical applications to help you support clients effectively.

Thanks to sponsorship by Security Mutual, this live webinar is free for NAIFA members.

Don’t miss your chance to deepen your understanding of one of today’s most powerful retirement planning tools. Register now to secure your spot.

3 min read

Bobby Johnson of Midland National Life Insurance Company Joins NAIFA Industry Leadership Board

By NAIFA on 5/8/25 9:12 AM

NAIFA has appointed Bobby Johnson, Chief Distribution Officer of Midland National Life® Insurance Company, to the Industry Leadership Board (ILB).

2 min read

Member Spotlight on Chris Henderson: Building a Successful Career and Advocating for the Industry with NAIFA

By NAIFA Membership on 5/5/25 6:47 PM

Chris Henderson, a dedicated member of NAIFA since 2014, has built a successful career in the financial services industry, making a lasting impact at both the local and national levels. Based in Madison, Wisconsin, Chris works with M3 Insurance, where he specializes in life insurance for both individuals and businesses, as well as executive benefits. For Chris, the opportunity to help people and meet new, interesting individuals keeps him motivated every day. His background in finance, combined with his business school education, led him to join M3 Insurance, where he has spent the past 20 years helping the company grow its financial services division, through his registration as an investment advisor representative with Global Retirement Partners, LLC, dba M3 Financial, an SEC registered investment advisor. Chris serves as Managing Director of M3 Financial.

38 min read

Empowering Women in Finance With Lindsey Lewis

By Advisor Today on 5/5/25 11:12 AM

Lindsey Lewis is a Chartered Financial Consultant and a Certified Financial Planner who champions the advancement of women in the financial industry through research, education, and advocacy. She leads various initiatives, encompassing podcasts, social media, and events fostering community and professional growth for women advisors. Recognized for her contributions, Lindsey has been honored with accolades, including InvestmentNews’ 40 Under 40 and the 2024 Female Trailblazer of the Year award. She volunteers at nonprofits and holds degrees in personal financial planning and an MBA from Utah Valley University.

2 min read

May Is Disability Insurance Awareness Month

By Kevin Mayeux on 5/1/25 9:25 AM

May is Disability Insurance Awareness Month (DIAM), an important time to highlight the critical role disability insurance plays in protecting the financial well-being of American workers and their families. NAIFA is committed to raising awareness and educating about the necessity and value of disability insurance.

NAIFA proudly participates in Disability Insurance Awareness Month, a national initiative led by Life Happens. Through this campaign, we provide financial professionals with resources to educate their clients about the importance of disability insurance, helping them secure critical protection against unforeseen financial challenges.

39 min read

Empowering Financial Voices With Erica McQuade

By Advisor Today on 4/30/25 11:17 AM

Erica McQuade is a government relations expert specializing in federal lobbying and advocacy. With a strong background in political advocacy, she actively engages in legislative initiatives that impact the financial services industry. Erica is a featured speaker at events like the NAIFA Women’s Financial Security Fly-In, where she empowers women financial professionals to advocate for their clients and communities. Her dedication to public affairs underscores her commitment to advancing financial security and industry representation.

2 min read

Social Security Administration to Reinstate National Social Security Month

By NAIFA on 4/23/25 2:29 PM

The Social Security Administration announced that it is reinstating National Social Security Month, a campaign to raise public awareness about accessing and optimizing benefits. Last observed in 2019, the campaign was paused during the pandemic and has been revived to help Americans make informed decisions about their retirement income.

Every day, 10,000 Baby Boomers become eligible to claim Social Security, creating an opportunity for financial professionals to guide clients through one of the most important steps in their retirement journey. NAIFA is committed to helping financial professionals turn this critical moment into opportunity through powerful tools and training, including the Registered Social Security Analyst (RSSA) program and educational resources like the on-demand webinar, "Social Security Financial Wellness: Help Your Clients Maximize Their Benefits." (NAIFA Members may access the webinar here.)

2 min read

NAIFA advocacy meets growing demand for financial literacy education

By Kevin Mayeux on 4/22/25 2:53 PM

Financial literacy is a critical life skill that’s becoming more important as today’s students prepare to navigate a changing financial landscape. According to a 2024 report by Tyton Partners and Next Gen Personal Finance, just one personal finance course in high school can translate into a lifetime benefit of nearly $100,000. That powerful statistic should prompt action from policymakers, educators, and communities nationwide.

1 min read

NAIFA Partner SAMUSA Celebrates 30 Years of Success

By NAIFA on 4/18/25 9:51 AM

NAIFA wishes a happy 30th anniversary to our affinity partners Mickey Straub and the SAMUSA team. Since launching and naming the industry in 1995, they have pioneered sales activity management solutions and collaborated with industry giants such as MetLife, New York Life, Northwestern Mutual, Ameriprise, MassMutual, Knights of Columbus, and others, as well as top-performing firms and producers.

4 min read

Loan Split Dollar - A Renaissance in the Making?

By Andrew Rinn, JD, CFP, CLU, ChFC on 4/17/25 11:46 AM

Loan split dollar remains one of those advanced market strategies that engenders two distinct reactions among financial professionals. One reaction sees nearly unlimited opportunity in the executive business market, while another relegates this concept to the esoteric and inapplicable. Though the latter reaction may be natural for those still stuck in an early 2000s mindset, today’s financial professionals would be remiss if they didn’t seize this impactful strategy and place it in their executive benefit toolkit.