As we mark November, long-recognized as National Long-Term Care Awareness Month, I want to extend my thanks to the Tennessee Department of Commerce & Insurance for stepping forward with a public campaign to shine a spotlight on long-term care planning for the future. Their announcement reminds us that as Americans live longer lives, the possibility of needing long-term support services climbs significantly.

2 min read

Planning Today for Tomorrow’s Care

By Kevin Mayeux on 11/17/25 4:32 PM

Topics: Long-Term Care Long-Term Care Insurance

3 min read

NAIFA Helps You Make the Most Out of Long-Term Care Awareness Month

By Kevin Mayeux on 11/3/25 6:00 PM

November is Long-Term Care Awareness Month and NAIFA is marking the occasion by spreading the word about caregiving and long-term care and providing financial professionals with valuable ideas and information. On November 19, NAIFA’s Limited and Extended Care Planning Collective is sponsoring an online event: “The Care Economy: Where Compassion Meets Capital.” It will feature seven 20-minute sessions by industry thought leaders who will share what advisors and agents need to know about the present and future of caregiving and long-term care. They will discuss such topics as the current state of long-term care insurance, the benefits of right-sizing LTC coverages, the role of annuity products in LTC planning, how to talk about LTC with younger clients, and much more.

Topics: Long-Term Care Long-Term Care Insurance

4 min read

NAIFA Introduces Its Peak 65 Series Addressing How the Financial Service Industry is Changing to Meet the Needs of Senior Americans

By NAIFA on 11/12/24 1:54 PM

NAIFA’s Lifetime Healthcare Center is presenting “The Peak 65 Series: Impact Day for Lifetime Healthcare,” a one-day virtual event, November 19, beginning at 11 am eastern. It features a dozen 20-minute TED Talk-like presentations covering timely topics on the financial implications of longevity and aging. Presenters include recognized thought leaders offering insights on long-term care, disability income, hybrid insurance products, Medicare, federal and state legislative and regulatory considerations, and more.

Topics: Long-Term Care Medicare Press Release Lifetime Healthcare Center

3 min read

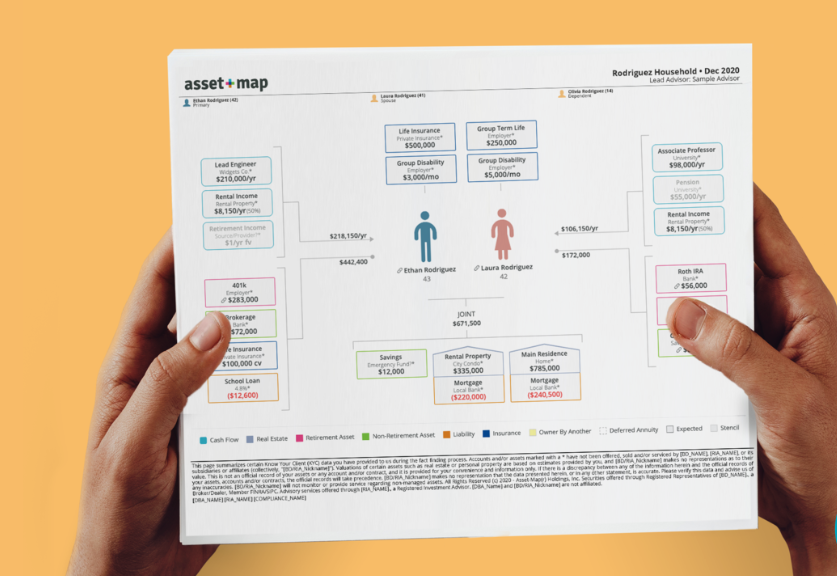

NAIFA Introduces Innovative “Caring Conversation” Stencil in Collaboration with Asset-Map

By NAIFA on 5/22/24 1:47 PM

Asset-Map and NAIFA are co-hosting a webinar showcasing the new "Caring Conversation" stencil designed by Carroll Golden, author, speaker, and Executive Director of NAIFA's Centers of Excellence. Learn how to use this tool to have more comprehensive conversations with your clients and tackle tough topics such as long-term care with grace and ease.

Special Webinar on The Caregiving Conversation for FAs

When: Thursday, June 6th

Time: 2 pm eastern

Arlington, VA – The National Association of Insurance and Financial Advisors (NAIFA) is excited to announce the launch of the “Caring Conversation” Stencil, a new tool developed by Carroll Golden, Executive Director of NAIFA's Centers of Excellence. This revolutionary stencil is integrated into the Asset-Map software platform, enhancing the toolkit available to financial advisors. This innovation aims to provide advisors with the means to offer comprehensive financial planning solutions, encompassing short-term, long-term, and extended care scenarios.

The “Caring Conversation” Stencil has been crafted with precision to assist advisors in mapping out all possible financial implications of caregiving scenarios. This tool allows for a more holistic approach to financial planning by addressing the specific needs related to caregiving, a critical aspect often overlooked in traditional financial planning processes.

Carroll Golden, the architect of the “Caring Conversation” Stencil and a prominent figure in caregiving financial planning, commented on the release, "With the growing need for specialized financial advice in the context of caregiving, it became essential to provide a tool that empowers advisors to address these unique challenges comprehensively. The “Caring Conversation” Stencil is designed to seamlessly integrate into the existing framework of Asset-Map’s software, ensuring that advisors can provide targeted guidance efficiently and effectively."

Asset-Map, known for its innovative financial planning software, will now feature the “Caring Conversation” Stencil as a part of its platform. This inclusion aims to facilitate advisors in delivering personalized and precise financial planning strategies that account for the complexities of caregiving. The stencil enhances advisors' ability to visualize and manage their clients' financial landscapes, considering the potential financial impact of caregiving responsibilities.

Topics: Long-Term Care Financial Planning Press Release FinTech Asset-Map

3 min read

It's Long-Term Care Awareness Month: Make Sure Your Clients Prepare for Any Eventuality

By NAIFA on 11/2/23 10:54 AM

November is National Long-Term Care Awareness Month and it is a great time to bring potential limited and extended care planning needs top-of-mind with your clients. It is important for every comprehensive financial plan to include LTC considerations. So even if LTC insurance is not your primary line of business, Long-Term Care Awareness Month gives you a good opportunity to get clients up to speed.

Topics: Long-Term Care Long-Term Care Insurance Limited & Extended Care Planning Center

1 min read

46% of Financial Professionals Don't Recommend LTC Insurance

By NAIFA on 7/20/23 5:21 PM

A study conducted by OneAmerica found that 46% of financial professionals do not recommend long-term care (LTC) protection to their clients.

The study highlights a potential gap in helping clients prepare financially for potential LTC expenses. It is estimated that almost 70% of individuals over the age of 65 will require LTC services at some point in their lives, making LTC protection an important aspect of retirement planning.

Topics: Long-Term Care Research/Trends Long-Term Care Insurance

2 min read

Change the Conversation with Financial Longevity Wellness

By NAIFA on 3/13/23 10:12 AM

Want to differentiate yourself? Then change the conversation! A hot topic that every client is concerned about is Financial Longevity Wellness. Today’s clients are worried about outliving or outspending their money or getting caught in an expensive ‘sandwich generation’ situation, or worrying about family or business financial wellness.

Join the next Advisor Today webinar on Wednesday, March 23 at 12 pm eastern, as Carroll Golden, Executive Director of NAIFA's Centers of Excellence, demonstrates a three-step formula to show how to incorporate Financial Longevity Wellness in the products and services you provide, while staying focused on your client’s story.

Topics: Long-Term Care Webinar Limited & Extended Care Planning Center Insurance

2 min read

Join NAIFA at the ILTCI Conference in Denver, March 12-15

By NAIFA on 2/21/23 1:39 PM

NAIFA will join our Limited & Extended Care Planning Center (LECP) partner, ILTCI, for the 2023 ILTCI Conference in Denver, CO, from March 12-15, 2023, at the Sheraton Downtown Denver.

ILTCI’s annual educational conference is for representatives of the long-term and extended care planning community and other strategic allies, including providers, public policy institutions, professional organizations, federal, state, and local government agencies, and the public.

Topics: Long-Term Care Extended Care Limited & Extended Care Planning Center

1 min read

Upcoming Webinar: An Alternative to Long-Term Care Coverage

By NAIFA on 1/25/23 11:51 AM

When long-term care insurance is not an option due to a person's health and/or finances, there may be an alternative solution to a difficult situation. Limited long-term care insurance can be an option to help during your client's time of need.

Register now for this upcoming webinar discussing limited long-term care on Tuesday, February 7 at 2 pm eastern.

Topics: Long-Term Care Limited Care Webinar Limited & Extended Care Planning Center Insurance

5 min read

How to Talk to Your Parents About Long-Term Care

By Cameron Huddleston on 12/9/22 9:30 AM

As your parents age, there’s a good chance they will need long-term care. According to the Department of Health and Human Services, more than half of Americans turning 65 today will develop a disability serious enough that they will need daily help with the basic activities of living. Most will need care for less than two years, but 1 in 7 will need assistance for more than five years.

As tough as it might be to imagine your parents being unable to care for themselves, the thought of discussing this possibility with them probably seems even harder. But it’s important to talk to your parents sooner rather than later to develop a plan for long-term care if they ever need it. If you wait for an emergency to strike, emotions will be running high and you’ll likely have fewer options to deal with your parents’ need for care.

.png)

.png)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)