Current data continues to bear out the fact that new year’s resolutions do not stick. In fact, of those who set financial resolutions at the beginning of each new year, statistics tell us that 64% have already given up on them by the end of January. Sadly, just 9% successfully stick with their resolutions throughout the whole year.

4 min read

The Truth Regarding Financial Resolutions

By Ike Trotter on 2/18/26 2:19 PM

Topics: Financial Planning Financial Literacy

35 min read

Charting Success in the Financial Advisory World With Chris Roper

By Suzanne Carawan on 8/27/24 2:12 PM

Chris Roper is a seasoned financial advisor who is passionate about helping individuals navigate their financial journeys as a fiduciary and an educator. With over 14 years in the industry, he specializes in 401K advising and personal finance management for high-net-worth individuals. Beyond his professional endeavors, Chris harbors a love for travel, seeking experiences and lessons to bring back to his practice. His approach to business is characterized by his servant leadership, collaborative spirit, and personal goal to help over a million people. Chris has been honored as one of the National Four Under 40 by Advisor Today, recognizing his outstanding contributions to the financial advising industry.

Topics: Financial Planning Podcast Member Spotlight

3 min read

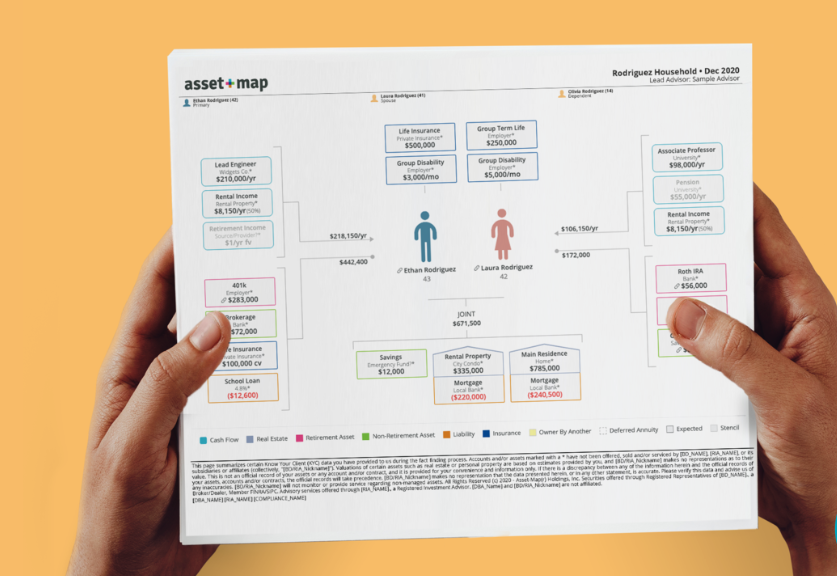

NAIFA Introduces Innovative “Caring Conversation” Stencil in Collaboration with Asset-Map

By NAIFA on 5/22/24 1:47 PM

Asset-Map and NAIFA are co-hosting a webinar showcasing the new "Caring Conversation" stencil designed by Carroll Golden, author, speaker, and Executive Director of NAIFA's Centers of Excellence. Learn how to use this tool to have more comprehensive conversations with your clients and tackle tough topics such as long-term care with grace and ease.

Special Webinar on The Caregiving Conversation for FAs

When: Thursday, June 6th

Time: 2 pm eastern

Arlington, VA – The National Association of Insurance and Financial Advisors (NAIFA) is excited to announce the launch of the “Caring Conversation” Stencil, a new tool developed by Carroll Golden, Executive Director of NAIFA's Centers of Excellence. This revolutionary stencil is integrated into the Asset-Map software platform, enhancing the toolkit available to financial advisors. This innovation aims to provide advisors with the means to offer comprehensive financial planning solutions, encompassing short-term, long-term, and extended care scenarios.

The “Caring Conversation” Stencil has been crafted with precision to assist advisors in mapping out all possible financial implications of caregiving scenarios. This tool allows for a more holistic approach to financial planning by addressing the specific needs related to caregiving, a critical aspect often overlooked in traditional financial planning processes.

Carroll Golden, the architect of the “Caring Conversation” Stencil and a prominent figure in caregiving financial planning, commented on the release, "With the growing need for specialized financial advice in the context of caregiving, it became essential to provide a tool that empowers advisors to address these unique challenges comprehensively. The “Caring Conversation” Stencil is designed to seamlessly integrate into the existing framework of Asset-Map’s software, ensuring that advisors can provide targeted guidance efficiently and effectively."

Asset-Map, known for its innovative financial planning software, will now feature the “Caring Conversation” Stencil as a part of its platform. This inclusion aims to facilitate advisors in delivering personalized and precise financial planning strategies that account for the complexities of caregiving. The stencil enhances advisors' ability to visualize and manage their clients' financial landscapes, considering the potential financial impact of caregiving responsibilities.

Topics: Long-Term Care Financial Planning Press Release FinTech Asset-Map

2 min read

Preparing Now for the Challenges Ahead: Guiding Clients Through Tax & Estate Planning in 2023 & 2024

By NAIFA on 8/16/23 12:58 PM

Brought to you exclusively by NAIFA and the Society of FSP, this essential webinar delves deep into the time-sensitive implications of provisions in the Tax Cuts and Jobs Act (TCJA) of 2017 that are scheduled to sunset by 2025. The panel of industry experts will arm you with strategic insights, ensuring you capitalize on evolving planning opportunities and prepare your clients effectively for the imminent shifts in the tax landscape.

Topics: Financial Planning Legacy Planning Tools Taxes

2 min read

Mastering Retirement Income: Decumulation Diversification Strategies Revealed

By NAIFA on 5/31/23 3:51 PM

If you are concerned about diversifying your clients' income during retirement and are searching for strategies to protect against potential increases in taxes and inflation, then join the next Advisor Today webinar on Thursday, June 22 at 2 pm eastern with Allianz.

At "Decumulation Diversification," Schyler Adams, Director of Advanced Strategies & Planning Platforms will reveal concepts and innovative approaches to secure your clients' financial future. Don't miss this opportunity to optimize retirement income and help your clients achieve long-term financial stability.

Topics: Retirement Planning Financial Planning Retirement Webinar Advisor Today

4 min read

Winning the Wealth Transfer Game

By Cameron Huddleston, Carefull Family Finance Expert on 5/30/23 10:00 AM

You’ve likely heard or seen this statistic: Only 13% of investors choose to work with the same advisor their parents use.

That’s from a 2019 survey by Cerulli Associates. The findings of a 2021 Cerulli survey are a little more promising: Those who said they were willing to stick with their parents’ advisors after inheriting their parents’ wealth was closer to 30%.

However, that still means an overwhelming majority of heirs plan to take their parents’ money and run … to other advisors. And that amount of money is substantial. Cerulli projects that $76.2 trillion in assets—that’s trillion with a T—will be transferred to heirs through 2045.

Topics: Financial Planning

1 min read

Kathleen Owings Shares How to Put Your Money to Work

By NAIFA on 5/19/23 9:30 AM

Kathleen Owings makes her appearance on the Advisorist Virtual Advisor Power Hour this coming Wednesday, May 24 at 12 pm eastern. Kathleen will discuss critical lessons from her book, Put Your Money to Work: A Woman’s Guide to Financial Confidence, in order to help more women with their finances with advice that was never taught in school.

Kathleen will also share the story of her non-traditional route into the financial services industry and how it has helped during times of high market volatility or challenging life events that her clients have experienced.

Topics: Financial Planning Talent Development Center Members Webinar NAIFA Partner Producer Sales & Marketing

1 min read

Are You Doing Enough to Protect Your Business?

By NAIFA on 5/18/23 2:15 PM

Errors & Omissions (E&O) insurance can be an essential part of every business' risk management plan. On Thursday, June 1 at 2 pm eastern, Ross Jordan, CPCU, of NAIFA partner CalSurance Associates will outline the current E&O landscape for financial professionals and give you loss prevention tips to help you protect your practice.

In this Business Performance Center webinar, explore recent E&O claim trends, learn what other agents are doing to protect their businesses, and what kind of coverages you should be reviewing for your practice's E&O insurance.

Topics: Financial Planning Grow Your Business Protect Your Business Business Performance Center Insurance NAIFA Partner

1 min read

Improve Your Clients' Financial Health in 15 Minutes or Less

By NAIFA on 5/9/23 10:30 AM

At this Business Performance Center webinar, Alison Susko and Mike Hemmert of NAIFA partner Asset-Map will show you how in 15 minutes or less, you can gather and place the most critical information about your clients' financials into one, easy-to-use and easy-to-share picture.

Mark your calendars and register now for "Scaling Advice: How to Make the Financial Planning Process More Efficient," taking place on Thursday, May 18 at 12 pm eastern.

Topics: Financial Planning Grow Your Business Business Performance Center Insurance NAIFA Partner

10 min read

Top 15 Reverse Mortgage Loan Questions Answered

By Harlan Accola on 1/19/23 10:02 AM

Reverse mortgage loans are widely misunderstood, and many homeowners and advisors have a strong negative bias against them. Unfortunately, those misconceptions and preconceptions hold back many ideal candidates from ever considering a reverse mortgage.

Today’s reverse mortgage loans are not the same as they were even a decade ago, and it is to your advantage as a trusted financial professional to take a fresh look at them, as they can often be a viable solution to many of the financial challenges that retirees face.

The aim of this piece is to help you understand both common, and somewhat less common, questions about reverse mortgages. Armed with the facts, you will have a much clearer picture of whether a reverse mortgage might be right for older-adult homeowners you advise.

Note: Most, but not all, reverse mortgages today are a Home Equity Conversion Mortgage (HECM), the only reverse mortgage insured by the Federal Housing Administration (FHA). This article refers only to the HECM reverse mortgage.

.png)

.png)

.png)

.png)

.png)

.jpg)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)