According to the 2024 Insurance Barometer Study by Life Happens and LIMRA, 59% of U.S. adults use social media to find information about financial and insurance products. Recognizing this growing trend, Life Happens, now part of the NAIFA family, offers NAIFA-branded social media content covering life insurance, disability insurance, long-term care insurance, annuities, and general financial planning.

1 min read

Social Media Solutions Webinar for NAIFA Members: Campaigns, Stories, and Tools

By NAIFA on 1/3/25 11:16 AM

2 min read

Happy New Year from NAIFA!

By Kevin Mayeux on 1/2/25 1:01 PM

Happy New Year from your friends and colleagues at NAIFA. I hope you had a joyful and restful holiday season.

Topics: NAIFA CEO Executive Summary

3 min read

NAIFA Member Spotlight: Joe Sparacio: Championing Advocacy and Empowering the Financial Services Industry

By Emily Cabbage on 12/19/24 6:32 PM

Joe Sparacio, CLU, LUTCF, CLF, a 30-year veteran of the financial services industry and loyal member since 1991, stands as a beacon of dedication and leadership. His career, marked by stints at major firms such as Prudential Financial, MassMutual, and now National Life Group, reflects a deep commitment not just to his profession but also to its broader impact. Joe’s journey illustrates the fusion of personal success, community impact, and industry stewardship, with a significant part of his story woven through his connection with the National Association of Insurance and Financial Advisors (NAIFA).

35 min read

Navigating Financial Services in a Digital World With Ryan Pinney

By NAIFA on 12/18/24 9:54 AM

Ryan Pinney is an insurance and financial services professional known for his innovative approach to leveraging technology to enhance client experiences. A past National Trustee and a respected figure in the industry, he is renowned for his contributions to tech integration within financial services and his dedication to serving his clients and the larger community. Ryan has a distinguished background in military service, complementing his commitment to providing outstanding service in his field. He advocates for technology, professional growth, and political advocacy in financial services.

Topics: Podcast

43 min read

Financial Decisions Are Family Decisions

By NAIFA on 12/12/24 6:13 PM

Dr. John Migliaccio is a financial services expert, recognized speaker, author, and thought leader on demographic trends and their impact on financial advising. He is a seasoned expert in financial gerontology, focusing on the interplay between aging and financial planning. Through his long-standing career, Dr. Migliaccio has contributed extensively to the field, from academic research to practical applications in financial services. His expertise in financial gerontology provides valuable insights into how financial professionals can better serve their clients in the context of aging and intergenerational wealth transfer.

Topics: Podcast

3 min read

NAIFA Member Spotlight: Christopher Potts: A Visionary Leader Advancing Advocacy and Inclusion in Financial Services

By Emily Cabbage on 12/11/24 6:13 PM

Christopher Potts, a seasoned financial professional and passionate advocate for the financial services industry, exemplifies leadership, commitment, and a deep sense of responsibility. With a career spanning nearly two decades, Christopher has seamlessly combined his roles as a mentor, advisor, and advocate, leaving an indelible mark on the communities he serves and the industry he represents.

Topics: Member Spotlight

2 min read

Member Spotlight: Tyler Engelhaupt: Building a Career in Insurance Through Adaptability and Leadership

By NAIFA Membership on 12/6/24 4:24 PM

After earning a finance degree from Ball State University in Muncie, Indiana, Tyler Engelhaupt entered the insurance industry, initially seeking a case manager role with a focus on financial advising. Instead, he found himself in a sales position at Ash, where his career quickly flourished. Specializing in annuities and retirement planning, Tyler now works alongside other advisors to help clients achieve their retirement goals through customized financial strategies.

Topics: Member Spotlight

2 min read

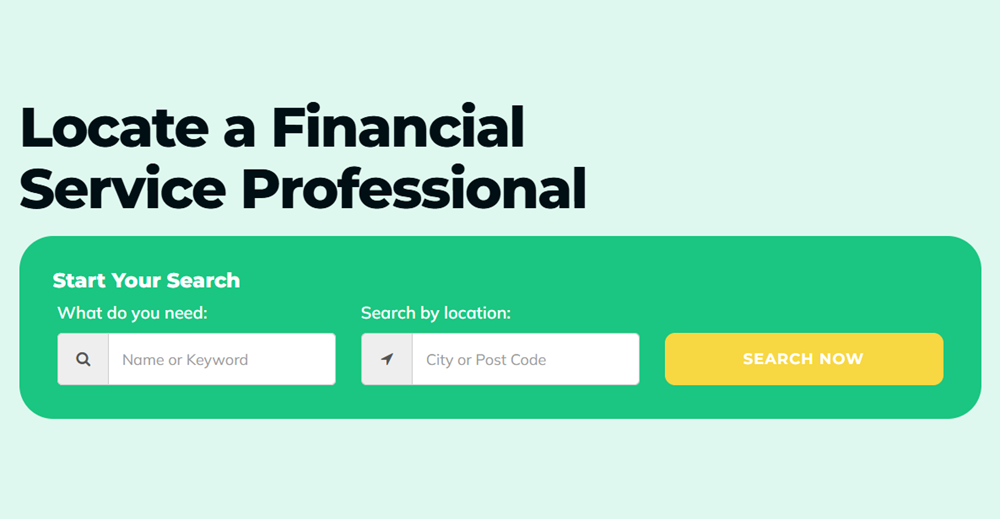

Refreshed Find a Financial Professional Search Directory Connects Consumers and NAIFA Members

By NAIFA on 12/5/24 1:23 PM

NAIFA, the leading association of financial professionals in the United States, has revitalized its Find a Financial Service Professional search directory to provide consumers with easy access to the highly skilled, experienced professionals who subscribe to NAIFA’s Code of Ethics. The tool is located on lifehappens.org, the consumer-facing website of NAIFA’s Life Happens community. It draws from a database of financial service professionals from various practice specialties who are NAIFA members, including legacy members of the Society of Financial Service Professionals, or subscribers to Life Happens Pro.

Topics: Consumers Life Happens Press Release

43 min read

Choosing a Life of Fulfillment

By NAIFA on 12/4/24 2:52 PM

John Davidson is a seasoned professional in the financial services industry, having served in various roles throughout his 44-year career. He was honored with NAIFA's Terry Headley Lifetime Defender Award in 2023, recognizing his significant contributions to the industry. A US Army veteran and former president of the NAIFA, John is also known for his dedication to mentoring the next generation of financial advisors in NAIFA's Future Leaders program. With a personal history deeply intertwined with life insurance and financial planning values, he brings a wealth of experience and a unique perspective to discussions on financial security and professional development.

Topics: Podcast

2 min read

Life Happens Content Available to NAIFA Members for February 2025 Insure Your Love Month

By NAIFA on 12/3/24 3:36 PM

Are you taking advantage of the Life Happens content NAIFA provides as a member benefit? For Life Insurance Awareness Month (September) and Long-Term Care Awareness Month (November), NAIFA members had access to specially curated content from NAIFA’s Life Happens community. Today, Life Happens is unveiling a new set of assets for Insure Your Love Month (February 2025). The content should be posted by 12 noon eastern.

.png)

-1.png)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)