Even well-heeled consumers with some understanding of long-term care issues are unlikely to have taken action to reduce their LTC financial risk, according to a survey by Lincoln Financial Group. Fewer than 30 percent of adults with household incomes above $150,000 and substantial investable assets* have purchased financial products to cover LTC needs. The majority of those surveyed do own other financial products, such as life insurance, individual retirement accounts, 401(k) plan accounts, individual stocks and bonds, or mutual funds.

Recent posts by Mark Briscoe

1 min read

Survey: Consumers Neglect Financial Risk Associated With Long-Term Care

By Mark Briscoe on 11/3/16 3:26 PM

Topics: Grow Your Business

2 min read

NAIFA's Revitalized Performance + Purpose 2016 a Great Success

By Mark Briscoe on 10/7/16 2:44 PM

Dear NAIFA Members,

4 min read

A Roundup of Media Coverage During the NAIFA P+P Conference

By Mark Briscoe on 10/4/16 9:19 AM

Whether or not you were able to attend the NAIFA Performance + Purpose conference in Las Vegas last month, you can get a good overview of the program from posts on the Advisor Today Blog and stories in trade publications. Following is a selection of stories on the conference.

Topics: Grow Your Business

1 min read

Skills Developed in the Military Can Lead to Success as an Advisor

By Mark Briscoe on 9/30/16 7:52 AM

A military veteran building his or her practice as an insurance and financial advisor can reach out to former military colleagues the same way they would to any other potential clients, long-time NAIFA member and NAIFA-Minnesota President Scott Wolf told LifeHealthPro.

Topics: Grow Your Business

3 min read

NAIFA Report Explores Challenges and Opportunities for Advisors Serving Diverse Markets

By Mark Briscoe on 9/26/16 2:17 PM

NAIFA’s new report, “Finding Success in Diverse Markets,” examines the diverse communities that are rapidly changing the face of America and offers critical insights to insurance and financial advisors for successful engagement. The report is sponsored by The Penn Mutual Life Insurance Company, an organization that recognizes the opportunities that lie ahead for advisors serving diverse markets.

Topics: Grow Your Business

1 min read

Even With the DOL Rule, Serving the Middle Market Should Remain a Focus

By Mark Briscoe on 9/22/16 3:00 PM

“You talk to people who will never be rich, but who don’t deserve to be poor,” Joe Jordan told attendees of his workshop, “Back to Basics: Surviving in a Post-DOL Environment,” at NAIFA’s Performance + Purpose conference.

“You talk to people who will never be rich, but who don’t deserve to be poor,” Joe Jordan told attendees of his workshop, “Back to Basics: Surviving in a Post-DOL Environment,” at NAIFA’s Performance + Purpose conference.

Topics: Grow Your Business

2 min read

Financial Uncertainty Makes This the "Greatest Time Ever to Sell Life Insurance"

By Mark Briscoe on 9/22/16 2:14 PM

There is a financial crisis coming in the United States, and it is going to be a big one, Van Mueller told attendees at NAIFA’s Performance + Purpose conference.

There is a financial crisis coming in the United States, and it is going to be a big one, Van Mueller told attendees at NAIFA’s Performance + Purpose conference.

Topics: Grow Your Business

2 min read

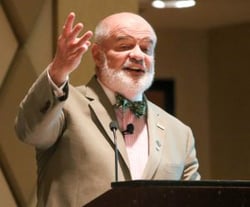

Frank Luntz Delivers Politically Charged Wit and Wisdom at NAIFA's P+P

By Mark Briscoe on 9/22/16 1:19 PM

Frank Luntz, the noted political consultant and pollster, entertained and enlightened attendees at NAIFA’s Performance + Purpose conference Monday with his humorous commentary on contemporary U.S. politics. He also provided insights into the use of language and how the specific words we use determine how our audience receives our message.

Frank Luntz, the noted political consultant and pollster, entertained and enlightened attendees at NAIFA’s Performance + Purpose conference Monday with his humorous commentary on contemporary U.S. politics. He also provided insights into the use of language and how the specific words we use determine how our audience receives our message.

2 min read

NAIFA Elects Officers and Trustees

By Mark Briscoe on 9/19/16 5:47 PM

1 min read

Addressing the Talent Gap

By Mark Briscoe on 9/18/16 3:15 PM

By 2018, a quarter of the current professionals in the insurance and financial services industry will retire, including half of the senior leaders at some companies. More than 400,000 insurance industry positions will need to be filled by 2020.

By 2018, a quarter of the current professionals in the insurance and financial services industry will retire, including half of the senior leaders at some companies. More than 400,000 insurance industry positions will need to be filled by 2020.

.png?width=300&height=250&name=Find%20A%20Pro%20Consumer%20Directory%20%20-%20Blog%20Email%20Ad%20(300x250%20px).png)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)