Entering the financial services industry in 2006, Dave Gannett quickly adapted and enjoyed working with other financial professionals by providing them with various investment vehicles and equipping financial advisors with information that helps benefit their clients. Eventually, he found himself serving as an advisor, focusing on global wealth and investment management.

2 min read

NAIFA Welcomes New Member Dave Gannett

By The Bancorp on 1/16/23 10:00 AM

Topics: Member Spotlight New Member Profile

3 min read

NAIFA Foundation Announces Inaugural Diversity Scholarship Recipients

By NAIFA on 1/12/23 12:35 PM

The NAIFA Foundation for Financial Security is pleased to announce that Gregory Jean Baptiste and Brooke Bastiaans-Brooks are recipients of the inaugural NAIFA Foundation Diversity Scholarship.

Jean Baptiste holds a bachelor’s degree in business management with an emphasis in finance from Brigham Young University-Idaho and is currently pursuing a master’s degree in financial planning and analytics at Utah Valley University. A first-generation Haitian immigrant, Jean Baptiste knows the value of a solid financial plan and is motivated to help all Americans achieve financial security. He is currently employed at a Wells Fargo branch in Lindon, UT.

Topics: Diversity Press Release NAIFA Foundation

6 min read

4 Key Behaviors to Understand During Economic Highs and Lows

By Simon Reilly on 1/11/23 10:00 AM

Understanding whether you are an Extrovert, Introvert, Ambivert, or Omnivert will help you to get through Behavioral and Economic Highs And Lows.

Behavioral research goes back to 400 B.C. when Empodocles stated that behaviors have four elements or roots; Fire, Air, Earth, and Water.

The elements of Fire and Air are said to be Extroverted.

The elements of Earth and Water are said to be Introverted.

Gone are the days of the plain old vanilla Extroverted or Introverted behavioral styles.

3 min read

NAIFA and WIFS Announce Stronger Partnership and Launch of Inaugural Women’s Financial Security Fly-In

By NAIFA on 1/10/23 1:00 PM

NAIFA and Women in Insurance & Financial Services (WIFS) have agreed to continue to work closely together and support their mutual goals in the areas of professional development; diversity, equity, and inclusion; and political advocacy. The two associations have signed an expanded partnership agreement. Under the agreement, NAIFA and WIFS share resources and NAIFA represents WIFS’s political advocacy interests.

Topics: Press Release Federal Advocacy Advocacy Partnerships WIFS

5 min read

Refine Wealth Strategies Is a NAIFA 100% Agency

By Ronan Friend on 1/9/23 10:00 AM

When Refine Wealth Strategies founders David J. Klein, CFP®, CLU, ChFC®, RICP; Brian Kelly, CLU, ChFC®, RICP, CASL; and Larwin W. Kauffman CFP®, CLU, ChFC, met in the early 2000s, they didn’t anticipate starting a business together. Fortunately, fate intervened—with a bit of help from 41-year NAIFA member Terry McTigue, CLU, ChFC®, who recruited all three to Northwestern Mutual.

Topics: NAIFA 100% Agency

2 min read

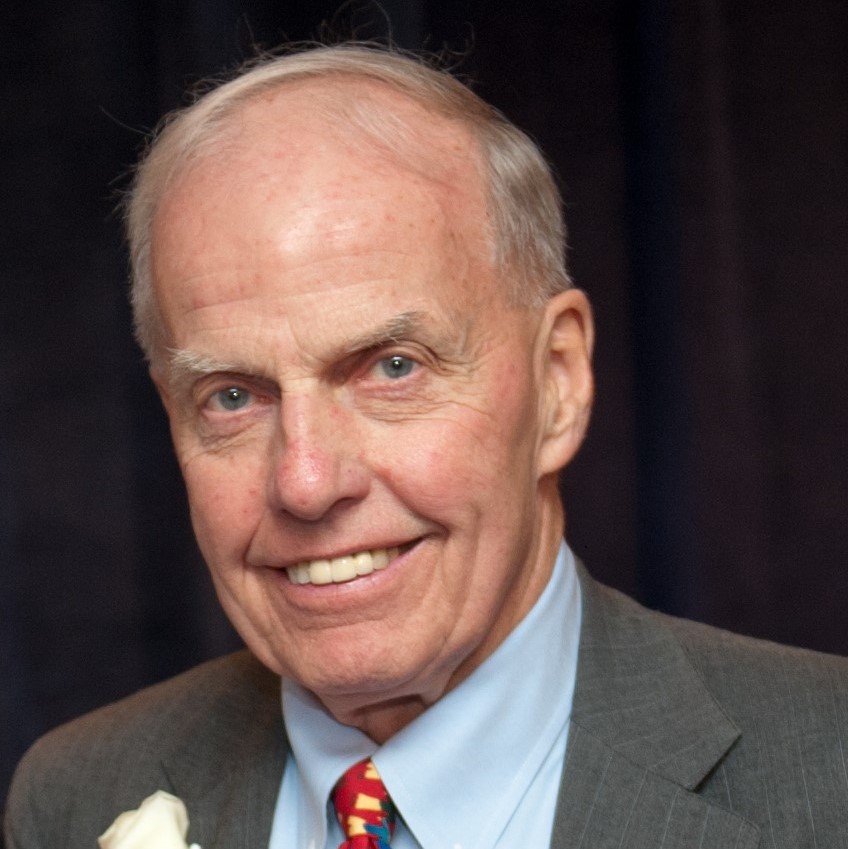

NAIFA Remembers Past President Michael C. Keenan

By NAIFA on 1/5/23 5:12 PM

NAIFA is saddened to share the news that NAIFA-National Past President Michael C. Keenan, CLU, ChFC, has passed away. Keenan was born in Evanston, IL, and made his career as an agent with Prudential in the Chicago area.

After serving as local and state president as well as on a myriad of local, state, and national committees, including IFAPAC (known then as LUPAC), he was elected National Secretary in 1982 and then served as NAIFA (then NALU) President in 1984-1985.

Topics: Leaders

2 min read

Get to Know 2023 NAIFA President Bryon Holz

By NAIFA on 1/4/23 4:41 PM

Bryon Holz, CLU, ChFC, LUTCF, CASL, LACP, President of Bryon Holz & Associates, Brandon, FL, is NAIFA's 2023 President.

Topics: Leaders

2 min read

Digital Marketing & AI Technology to Drive Life Insurance & Annuity Sales in 2023

By Ken Leibow on 1/4/23 10:00 AM

Digital Marketing had the biggest growth for generating insurance sales since 2021. In a recent global study conducted by Accenture, most insurance buyers now search for information on digital channels. 48% of insurance customers who responded to an Accenture survey stated that social media would factor into their insurance-buying decision. Introducing agents and training to effectively utilize email, social media, web-based advertising, text messages, and personalized videos which helps maximize their value delivery.

Data Analytics and Artificial Intelligence (AI) is the technology driving the industry to new insurance sales as it does with other industries in e-commerce. Winning agencies will become more data-driven and introduce agents to tools that utilize data analytics and AI to grow their businesses. Whether finding patterns based on past data to predict future events or leveraging AI to make assumptions and predictions beyond human capabilities, successful agents and agencies will take advantage of these new technology tools.

Topics: Life Insurance & Annuities Marketing Sales & Marketing Social Media Marketing FinTech Insurance

4 min read

Meet Loyal NAIFA Member Peter Glassman

By Ronan Friend on 1/3/23 10:00 AM

NAIFA-GWDC Past President Peter Glassman, CFP®, is a Founding Partner of Wealth Insight Partners and has been a loyal NAIFA member since 1989.

After graduating with a business and marketing degree in 1987, Glassman moved from Connecticut to Washington, D.C., where a family friend suggested he get into the insurance and financial services industry. After learning more he dove into what turned out to be the beginning of a career. Thirty-five years later, Glassman is still dedicated to helping his clients plan for their futures.

Topics: Member Spotlight Loyal Member Profile

33 min read

Year in Review: Camaraderie as a Strategy

By Advisor Today on 12/14/22 5:00 AM

Chris Gandy is the Founder of Midwest Legacy Group LLC, a boutique concierge insurance group for executives, professional athletes, physicians, business owners, and entrepreneurs. It focuses on the client's interests in wealth accumulation, wealth preservation, retirement strategies, insurance, asset protection, and investments.

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)