In today's competitive financial services environment, technology isn't just a support tool—it’s a strategic advantage. Life insurance agents and financial advisors who integrate the right software solutions into their workflow not only save time, but also significantly increase client engagement, retention, and revenue.

4 min read

Boost Productivity and Sales: How Life Insurance Agents and Financial Advisors Can Leverage Software and AI

By Ken Leibow on 5/30/25 9:43 AM

Topics: Practice Management FinTech Artificial Intelligence

2 min read

AI Is Coming. Is Your Practice Ready?

By NAIFA on 8/19/24 9:30 PM

Learn how the newest technologies are transforming insurance and financial services at NAIFA's Apex!

September 19-21 | The Arizona Biltmore

Topics: FinTech Apex

3 min read

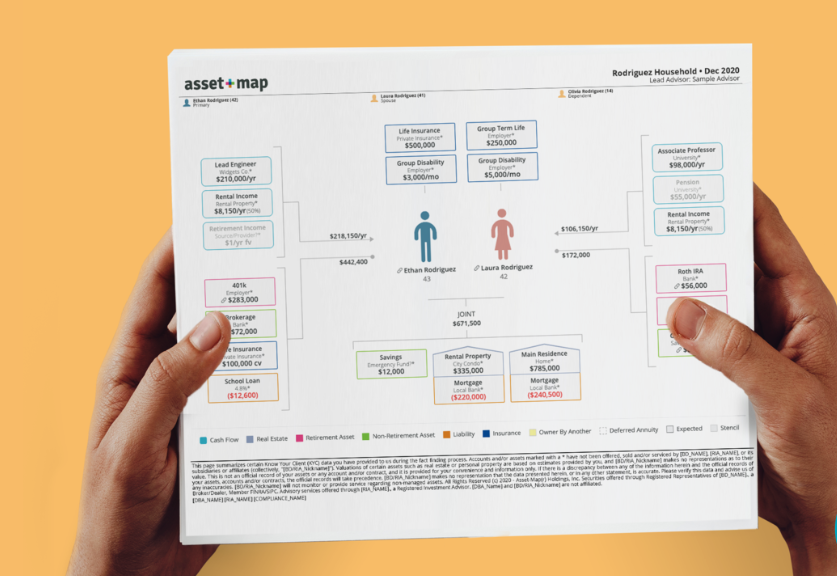

NAIFA Introduces Innovative “Caring Conversation” Stencil in Collaboration with Asset-Map

By NAIFA on 5/22/24 1:47 PM

Asset-Map and NAIFA are co-hosting a webinar showcasing the new "Caring Conversation" stencil designed by Carroll Golden, author, speaker, and Executive Director of NAIFA's Centers of Excellence. Learn how to use this tool to have more comprehensive conversations with your clients and tackle tough topics such as long-term care with grace and ease.

Special Webinar on The Caregiving Conversation for FAs

When: Thursday, June 6th

Time: 2 pm eastern

Arlington, VA – The National Association of Insurance and Financial Advisors (NAIFA) is excited to announce the launch of the “Caring Conversation” Stencil, a new tool developed by Carroll Golden, Executive Director of NAIFA's Centers of Excellence. This revolutionary stencil is integrated into the Asset-Map software platform, enhancing the toolkit available to financial advisors. This innovation aims to provide advisors with the means to offer comprehensive financial planning solutions, encompassing short-term, long-term, and extended care scenarios.

The “Caring Conversation” Stencil has been crafted with precision to assist advisors in mapping out all possible financial implications of caregiving scenarios. This tool allows for a more holistic approach to financial planning by addressing the specific needs related to caregiving, a critical aspect often overlooked in traditional financial planning processes.

Carroll Golden, the architect of the “Caring Conversation” Stencil and a prominent figure in caregiving financial planning, commented on the release, "With the growing need for specialized financial advice in the context of caregiving, it became essential to provide a tool that empowers advisors to address these unique challenges comprehensively. The “Caring Conversation” Stencil is designed to seamlessly integrate into the existing framework of Asset-Map’s software, ensuring that advisors can provide targeted guidance efficiently and effectively."

Asset-Map, known for its innovative financial planning software, will now feature the “Caring Conversation” Stencil as a part of its platform. This inclusion aims to facilitate advisors in delivering personalized and precise financial planning strategies that account for the complexities of caregiving. The stencil enhances advisors' ability to visualize and manage their clients' financial landscapes, considering the potential financial impact of caregiving responsibilities.

Topics: Long-Term Care Financial Planning Press Release FinTech Asset-Map

5 min read

Navigating the Evolving Landscape of Cyber Insurance and How it Relates to Cyber Compliance

By Ken Leibow on 2/15/24 3:31 PM

With over three decades of expertise in the Life Insurance sector, I've come to realize there's nothing more vital for safeguarding your business than cybersecurity. Whether you're a financial advisor, an insurance agent, a broker-dealer, or a principal of a brokerage agency, a single cyberattack could devastate your business. Adopting a Zero Trust approach is essential. Moreover, cybersecurity is crucial for meeting regulatory and compliance obligations. I urge you to conduct audits on your network and website. I'm here to assist you in securing a complimentary audit. Now, let's delve into some key insights on cyber insurance, compliance, and security.

Topics: FinTech Data Security

3 min read

Automating Health Insurance Sales, Back-Office, and Commission Accounting

By Ken Leibow on 8/1/23 4:25 PM

In the rapidly evolving health insurance sales landscape, efficient process management poses significant challenges for Field Marketing Organizations (FMOs) and Brokerage General Agencies (BGAs). Enrollment, quoting, customer management and engagement, and commissions are handled by disparate platforms that lack communication and may not be tailored to the industry's specific needs.

Topics: Health Care FinTech Insurance

4 min read

The Art of In-Force Policy Management: A Game-Changer for Life Insurance Advisors

By Ken Leibow on 7/5/23 10:00 AM

Two weeks ago, I had the privilege of spending time with Nick Bowman, CFP, MS, CEP, in New York City at the Insurtech Insights Conference. Previously associated with Lion Street as an Advanced Sales Professional, Nick now serves as the CEO of Motif Insurance, a company that is revolutionizing the future of in-force life insurance. Motif's primary objective is to empower advisors in managing their portfolios by harnessing the potential of data. Nick possesses exceptional expertise in in-force life insurance policies, making him not only a valuable contributor to this article but also the initiator of an important survey. The survey/questionnaire, consisting of just a couple of questions, can be accessed by clicking the link provided at the end of this article.

Topics: Life Insurance & Annuities Technology FinTech Insurance

3 min read

Why Insurance Carriers Should Leverage Data & Tech to Enhance the Consumer Experience

By Ken Leibow on 3/2/23 10:00 AM

Insurance and financial advisors need to be aware that carriers are investing in wellness apps and reward programs to help engage policyholders. This can be leveraged as an added value when an advisor is quoting a carrier’s life insurance product. One of the most challenging issues in insurance is the transient nature of carriers’ relationships with policyholders. Traditionally, coverage is bought out of necessity and then forgotten about unless – or until – a payout is required.

Topics: Running Your Practice FinTech Insurance

2 min read

Digital Marketing & AI Technology to Drive Life Insurance & Annuity Sales in 2023

By Ken Leibow on 1/4/23 10:00 AM

Digital Marketing had the biggest growth for generating insurance sales since 2021. In a recent global study conducted by Accenture, most insurance buyers now search for information on digital channels. 48% of insurance customers who responded to an Accenture survey stated that social media would factor into their insurance-buying decision. Introducing agents and training to effectively utilize email, social media, web-based advertising, text messages, and personalized videos which helps maximize their value delivery.

Data Analytics and Artificial Intelligence (AI) is the technology driving the industry to new insurance sales as it does with other industries in e-commerce. Winning agencies will become more data-driven and introduce agents to tools that utilize data analytics and AI to grow their businesses. Whether finding patterns based on past data to predict future events or leveraging AI to make assumptions and predictions beyond human capabilities, successful agents and agencies will take advantage of these new technology tools.

Topics: Life Insurance & Annuities Marketing Sales & Marketing Social Media Marketing FinTech Insurance

4 min read

Maximize Your Leads: Why Operating a Dynamic Ping Tree Is Essential for Underwriting More Insurance Policies

By Ken Leibow on 8/31/22 10:00 AM

In the past, I have written about lead generation solutions as well as tracking clients on customer relationship management tools (CRMs) and marketing programs, but there hasn’t been a focus on lead conversions. At an industry conference this year, I learned about Phonexa, the company working to bridge the gap to generate more sales from leads. It’s important that advisors, especially those who run agencies and invest heavily in lead generation through marketing, learn about maximizing those leads.

Topics: Marketing Technology Tools Sales & Marketing Technology FinTech CRM

2 min read

Become a Life Insurance eRetailer With Digital Direct to Consumer Sales

By Ken Leibow on 6/22/21 9:30 AM

Selling Life Insurance using a digital platform on your website for consumer direct insurance tools is now the hottest trend! Now more than ever, consumers want to shop, compare, and apply for coverage online and on their terms. The goal is to make the experience of protecting loved ones with life insurance as simple and stress-free as possible. Here are some key reasons why digital life insurance sales has gained momentum: COVID requiring remote sales; 72 million Millennials (25–40-year olds) who would rather shop on their own; massive use of mobile devices averaging 3.8 hours per day; and social media usage 2.5 hours per day for adults in the USA.

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)