Two weeks ago, I had the privilege of spending time with Nick Bowman, CFP, MS, CEP, in New York City at the Insurtech Insights Conference. Previously associated with Lion Street as an Advanced Sales Professional, Nick now serves as the CEO of Motif Insurance, a company that is revolutionizing the future of in-force life insurance. Motif's primary objective is to empower advisors in managing their portfolios by harnessing the potential of data. Nick possesses exceptional expertise in in-force life insurance policies, making him not only a valuable contributor to this article but also the initiator of an important survey. The survey/questionnaire, consisting of just a couple of questions, can be accessed by clicking the link provided at the end of this article.

Have you ever felt like you're navigating a maze when it comes to life insurance policy management? Don't worry; you're not alone. Whether you're a novice or a seasoned insurance agent, understanding and managing active, or "in-force," policies can seem like a daunting task. But here's the good news: this is the start of a series of articles that will help break down the complexities of policy management into digestible, easy-to-understand pieces.

Why Focus on In-Force Policies?

Let's begin by understanding the importance of managing in-force policies. Think of it as the foundation of a building. Just as a solid foundation is key to a sturdy building, managing in-force policies is critical to providing stellar service to clients, enhancing policy performance, and building a solid reputation in the insurance industry. In fact, in-force management is more than just an “annual review.” It gives you an opportunity to add more value to your clients. A 2020 Carson Group study found that clients who have 4 or more interactions per year with their advisor believe that they are receiving real value from their advisor, leading to higher overall client satisfaction and more willingness to refer a friend or family member.

The Pieces of the Puzzle: Understanding In-Force Policies

Like a complex puzzle, each in-force policy has many parts to consider—cash values, death benefits, policy loans, premium payments, and so on. Over the course of this series, we will delve into each of these components, providing you with a comprehensive understanding of what's in an in-force policy.

The Roadmap to Success: Managing In-Force Policies

Embarking on the journey of policy management begins with gathering all the necessary information. Over the next few articles, we will walk you through the process of requesting policy data from carriers, understanding policy contracts, and tracking any amendments to the policy.

The First Checkpoint: Ordering In-Force Ledgers

In the upcoming article, we'll take a closer look at in-force ledgers, which act like a projection of the policy. Comparing in-force illustrations to as-sold illustrations provide key insights into the policy's past and future. Learning how to order and interpret these ledgers is an essential skill in policy management.

Challenges Are Opportunities

Yes, there will be challenges. Deciphering in-force illustrations, interacting with policy service representatives, obtaining accurate information—these may seem daunting at first glance. But remember, each challenge is a stepping stone toward becoming an expert in policy management.

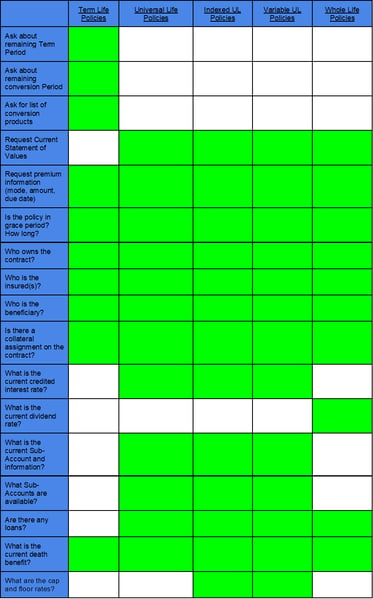

To guide you on this journey, we've provided a checklist of what to ask from insurance companies regarding different types of policies - term life, universal life, indexed universal life, variable universal life, and whole life. In our next article, we will detail what in-force ledgers to order as well.

Navigating the landscape of in-force policy management is indeed a demanding task, but it also opens the door to offering exceptional service to your clients and establishing a thriving practice. We're here to arm you with the knowledge and tools needed to turn challenges into opportunities and set a benchmark in the insurance industry.

Are you ready to step up your game in policy management? Start your journey here by filling out this questionnaire, and stay tuned for the next article in our series: "Mastering In-Force Ledgers." Let's revolutionize the way we approach life insurance policy management, one article at a time!

Ken Leibow is the Founder and CEO of InsurTech Express and a regular contributor to NAIFA's Advisor Today blog.

.png)

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)