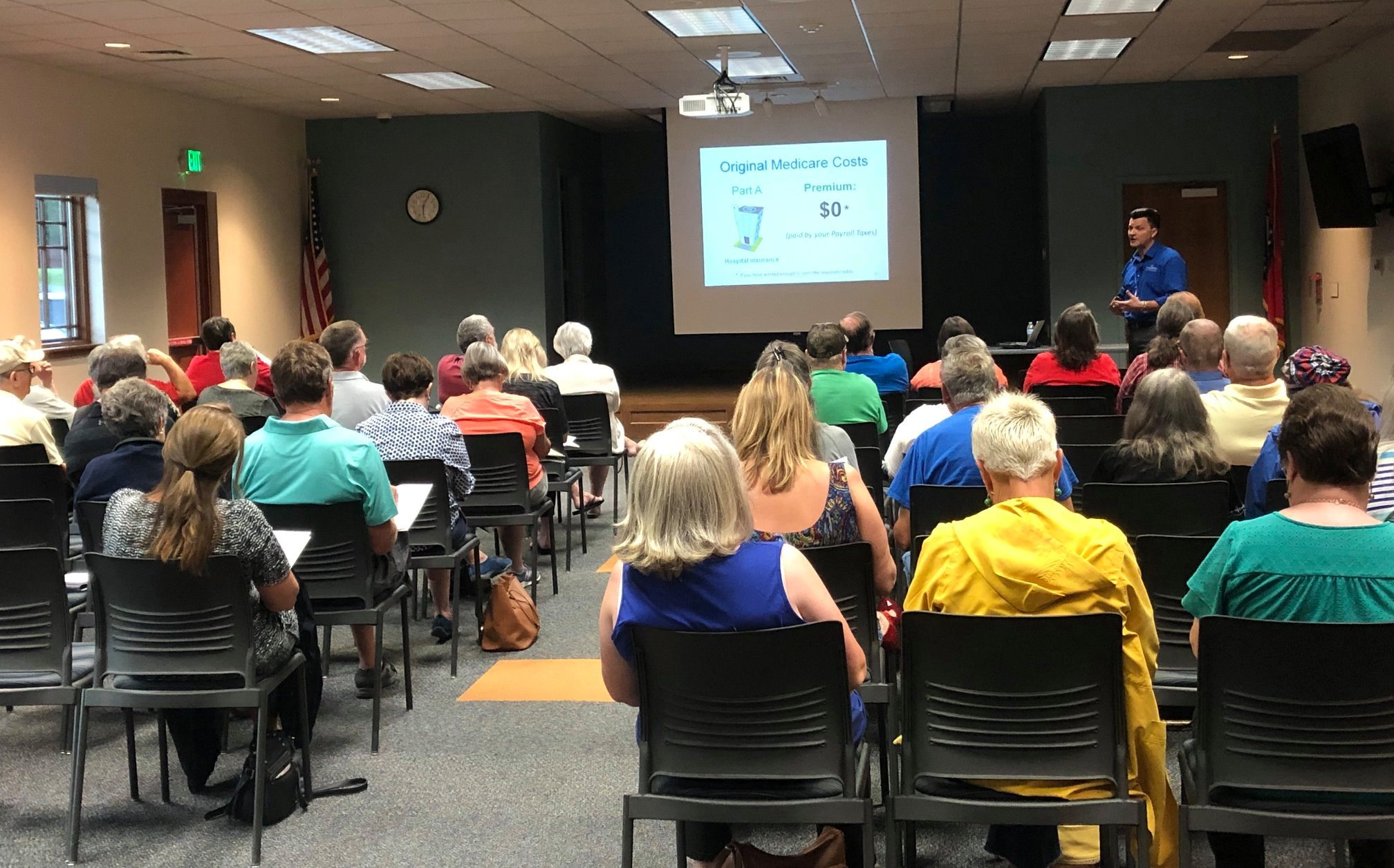

Matt Wagner of NAIFA Business Performance Center Partner, Client Focus, shares what agents and advisors need to know about AI and what it means for the industry.

Artificial Intelligence (AI) for the masses came online in December. It’s called ChatGPT. You can communicate with it at openai.com. It gives impressive answers to hard questions in seconds. Many think it will put Google search out of business. Maybe put schools out of business. AI is coming like a wrecking ball for repetitive, commodity work.

What about insurance agents? I was going to share my thoughts, but then it hit me.

Why not just ask AI?

So I did.

.jpg)

.jpg)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)