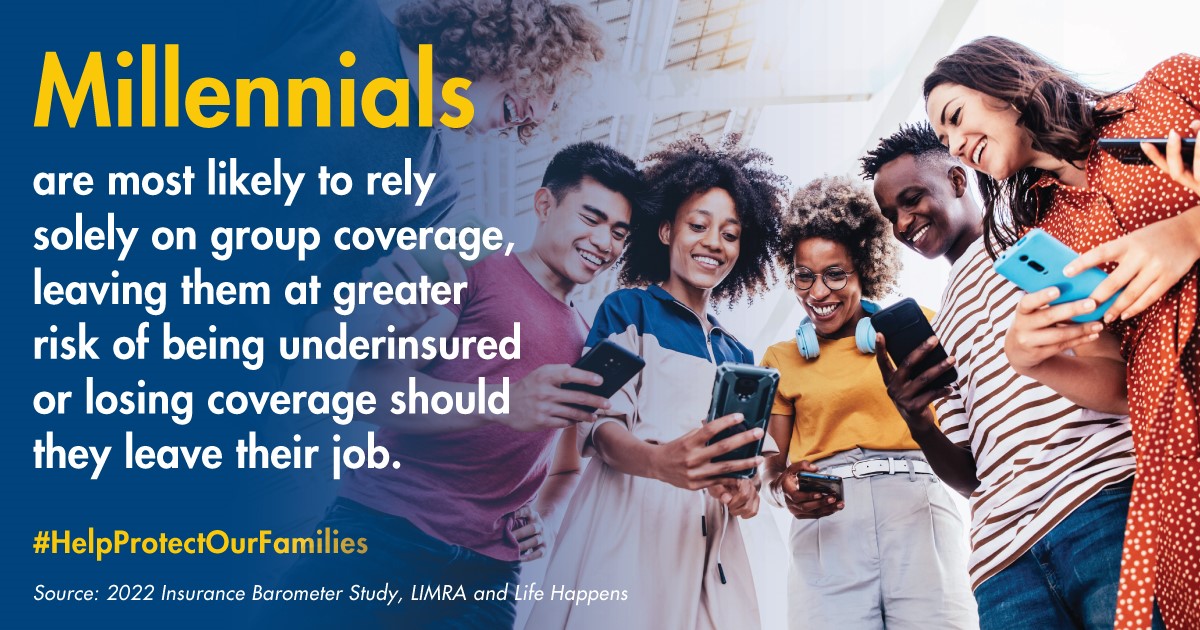

On July 20, NAIFA participated in the #GettingMillennialsInsured Twitter chat hosted by LIMRA and the American Council of Life Insurers (ACLI). The chat was an informative and insightful discussion with LIMRA, ACLI, NAIFA partner Life Happens, and Life Happens President & CEO Faisa Stafford.

Participants discussed:

- The impact of the COVID-19 pandemic on consumer attitudes toward life insurance

- How to increase awareness of the need for life insurance

- How to dispel misconceptions about life insurance

- How to increase access to life insurance

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)