While many advisors are well-equipped to help their clients evaluate their life insurance needs, some scenarios may call for outside-of-the-box solutions. Join NAIFA's Advisor Today on Thursday, December 8 at 2 pm eastern for the webinar, "4 Life Insurance Opportunities You May Have Missed," brought to you by Modern Life.

1 min read

Explore Life Insurance Opportunities You May Have Missed

By NAIFA on 11/29/22 2:57 PM

Topics: Life Insurance & Annuities Webinar Insurance

1 min read

Learn About Indexed Whole Life in the Next Advisor Today Webinar

By NAIFA on 11/22/22 1:28 PM

On November 29, Ohio National Vice President of Product Marketing Karl Kreunen will present "Skate Where the Puck is Heading: Indexed Whole Life as Your Product of Choice."

In the webinar, Kreunen will showcase Ohio National’s new Prestige 10 Pay Indexed Whole Life policy and discuss why it makes sense today and in the future. He will also give a demonstration of relevant sales applications for a multi-pay indexed whole life policy.

Topics: Life Insurance & Annuities Webinar Insurance

1 min read

The Top 3 Financial Products to Weather This Financial Storm

By NAIFA on 11/18/22 4:14 PM

Join NAIFA's Business Performance Center for a webinar on Tuesday, November 29 at 1 pm eastern. Sit down for a discussion with Harlan Accola of Fairway Independent Mortgage Corporation, and Caleb Guilliams, Founder of BetterWealth, to learn about the three products your clients must have to survive this intense financial storm.

Topics: Financial Planning Grow Your Business Business Performance Center Insurance

1 min read

Grow Your Business by Maximizing Your Data

By NAIFA on 10/10/22 10:30 AM

New Business Performance Center partner, AccuPoint Solutions, will host a data-driven webinar on Thursday, October 13 at 12 pm eastern. Join Founder & CEO of AccuPoint, Gary Weber, for "Data Diving: Understand and Maximizing Your Most Important Asset." Gary will help you how to best understand the complexity of the data you may have – or may want to purchase – for your sales, marketing, recruiting, and data analytics efforts.

Topics: Grow Your Business Business Performance Center Insurance

1 min read

Join the Advanced Practice Center for a Behavioral Insurance Webinar

By NAIFA on 10/5/22 2:45 PM

NAIFA and the Society of Financial Service Professionals will host an Advanced Practice Center webinar on Wednesday, October 12 at 2 pm eastern. Presented by John Hancock, join Matthew Gibson and John Snider II, JD as they share their insights in "Is Behavioral Insurance the Future of Life Insurance?"

Topics: Life Insurance & Annuities Continuing Education Webinar Insurance

1 min read

E4 Presents a Special BREW Featuring NAIFA Past President Juli McNeely

By NAIFA on 8/23/22 10:00 AM

On August 31, join NAIFA-Past President Juli McNeely, LUTCF, CFP, CLU for “Risk Matters,” a Building Relationships Every Week (BREW) webinar from E4 Insurance.

In this session, McNeely will share insights on how to help your clients evaluate risk and the importance of consistently analyzing risk. A loyal NAIFA member since 1996, McNeely is Past President of NAIFA-WI, a graduate of NAIFA’s Leadership in Life Institute (LILI), and a Financial Security Advocate.

Topics: Life Insurance & Annuities Life Insurance Awareness Month Webinar Leaders Potential Partners for Advisors Insurance

1 min read

Upcoming Virtual Event: Helping Middle-Income Families Protect Their Financial Future

By NAIFA on 8/11/22 10:00 AM

On August 24, tune in for "Helping Middle-Income Families Protect Their Financial Future," a LinkedIn Live event presented by NAIFA partners LIMRA and the American Council of Life Insurers (ACLI).

Hear insights into Americans' perception of life insurance from a panel of industry experts: Susan Neely, President and CEO of ACLI; David Levenson, President and CEO of LIMRA and LOMA; and Alison Salka, Ph.D., Senior Vice President and head of LIMRA research.

Topics: Webinar Help Protect Our Families Potential Partners for Advisors Insurance

4 min read

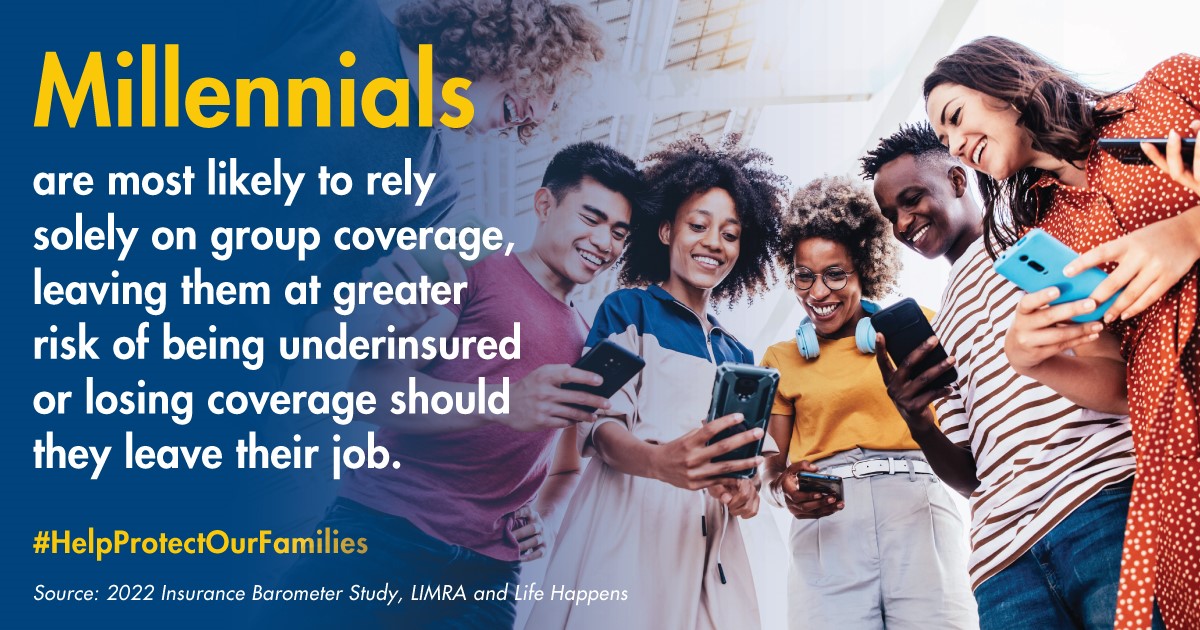

#GettingMillennialsInsured with LIMRA and ACLI

By Ronan Friend on 7/26/22 1:14 PM

On July 20, NAIFA participated in the #GettingMillennialsInsured Twitter chat hosted by LIMRA and the American Council of Life Insurers (ACLI). The chat was an informative and insightful discussion with LIMRA, ACLI, NAIFA partner Life Happens, and Life Happens President & CEO Faisa Stafford.

Participants discussed:

- The impact of the COVID-19 pandemic on consumer attitudes toward life insurance

- How to increase awareness of the need for life insurance

- How to dispel misconceptions about life insurance

- How to increase access to life insurance

Topics: Life Insurance & Annuities Research/Trends Insurance

1 min read

Being a Great Advisor: Help Your Clients Stay Healthy

By Dan Mangus, Vice President of Sales, Senior Marketing Specialists on 7/13/22 10:00 AM

As an insurance advisor for individuals on Medicare, it is critical that you do everything in your power to give your clients access to care through a well-thought-out and comprehensive insurance package. You can help them stay healthy by utilizing Medicare’s preventive health benefits. It can be challenging for your clients to keep up with the preventive services they have received and when they are eligible for another service.

Topics: Medicare Insurance

2 min read

Fifth Consecutive Quarter of Double-Digit Growth for U.S. Life Insurance Premium

By LIMRA on 6/30/22 10:00 AM

Total U.S. life insurance new annualized premium increased 17% in the first quarter of 2022, representing the fifth consecutive quarter of double-digit premium growth, according to LIMRA’s First Quarter 2022 U.S. Retail Life Insurance Sales Survey.

“Nearly half of life insurers reported premium gains in the first quarter but the majority of the growth came from the top 10 carriers. Nine of the top 10 reported double-digit growth. Combined, their sales increased 32% from last year,” said John Carroll, senior vice president, head of insurance and annuities, LIMRA and LOMA. “While the overall number of policies sold was lower than the record sales set in first quarter 2021, policy sales matched pre-pandemic levels.”

.png)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)