NAIFA’s Lifetime Healthcare Center is presenting “The Peak 65 Series: Impact Day for Lifetime Healthcare,” a one-day virtual event, November 19, beginning at 11 am eastern. It features a dozen 20-minute TED Talk-like presentations covering timely topics on the financial implications of longevity and aging. Presenters include recognized thought leaders offering insights on long-term care, disability income, hybrid insurance products, Medicare, federal and state legislative and regulatory considerations, and more.

4 min read

NAIFA Introduces Its Peak 65 Series Addressing How the Financial Service Industry is Changing to Meet the Needs of Senior Americans

By NAIFA on 11/12/24 1:54 PM

Topics: Long-Term Care Medicare Press Release Lifetime Healthcare Center

33 min read

Unlocking the Power of Medicare for Financial Advisors With Amanda Brewton

By NAIFA on 10/9/24 12:21 PM

Amanda Brewton is a seasoned Medicare expert with over 17 years in the industry. Opening her agency five years ago, she now oversees approximately 500 agents across 40 states and hosts two national conferences designed to empower and educate professionals in her field. Amanda is passionate about advocacy for seniors, ensuring they don't have to choose between essential needs due to Medicare complexities. Her innovative approach involves using themed training to enhance engagement and creating supportive communities for independent insurance agents.

Topics: Medicare Podcast Medicare Part D

1 min read

Buying or Selling an Agency – A Focus on Medicare

By NAIFA on 1/18/23 10:30 AM

Join Dan Mangus, VP of Growth and Development at Senior Marketing Specialists, for an Advisor Today webinar on Wednesday, January 25 at 12 pm eastern. In "Buying or Selling an Agency - A Focus on Medicare," Dan will guide you through the ins and outs of buying or selling an agency, and the top things you need to know when it comes to Medicare.

Topics: Medicare Webinar Insurance

1 min read

E4 Presents a Special BREW with 2021 4 Under 40 Winner Steve Walker

By NAIFA on 12/12/22 11:18 AM

This Wednesday, December 14 at 1 pm eastern, join NAIFA's first financial security champion, E4 Insurance Services, for their next Building Relationship Every Week (BREW) webinar.

This week's BREW will feature Steve Walker, CLTC, LUTCF, Vice President of Institutional Accounts at E4, loyal NAIFA member since 2009, and a NAIFA 4 Under 40 Award Winner in 2021.

Topics: Health Care Medicare Webinar Leaders Insurance

1 min read

Being a Great Advisor: Help Your Clients Stay Healthy

By Dan Mangus, Vice President of Sales, Senior Marketing Specialists on 7/13/22 10:00 AM

As an insurance advisor for individuals on Medicare, it is critical that you do everything in your power to give your clients access to care through a well-thought-out and comprehensive insurance package. You can help them stay healthy by utilizing Medicare’s preventive health benefits. It can be challenging for your clients to keep up with the preventive services they have received and when they are eligible for another service.

Topics: Medicare Insurance

3 min read

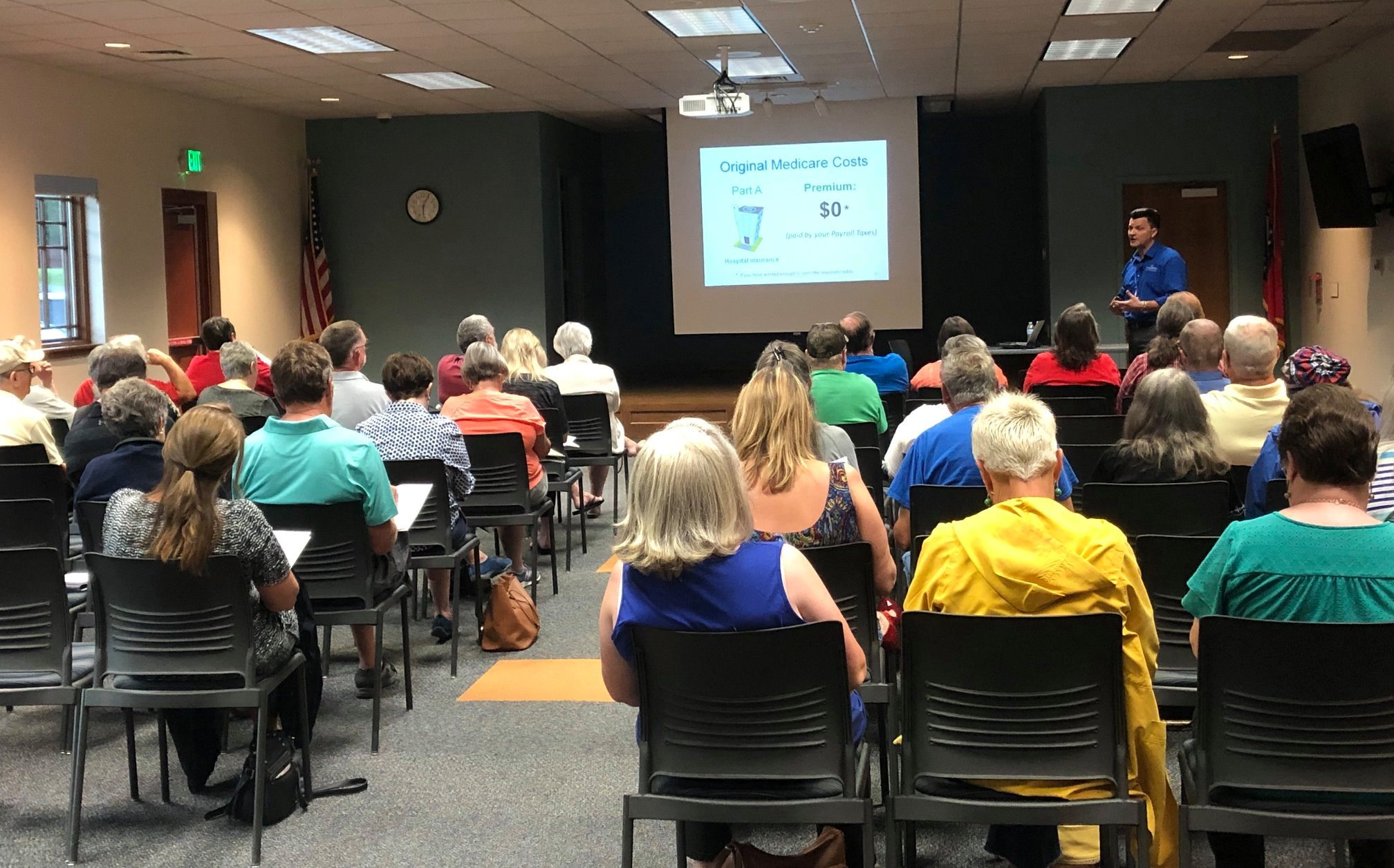

Grow Your Client Base with Targeted Seminars

By Wallace Stone, President of Medsupp National and CEO of the Medicare Education Network on 6/7/22 10:00 AM

As an insurance agent, getting in front of people to deliver your message can be one of your most challenging tasks. For agents looking to attract new clients in today’s market, expertise is everything. Seminars establish your expertise and can put you in front of a large group of people in a single setting. This type of marketing is one of the most cost-effective and time-saving ways to grow your business.

When giving a seminar, you need to study the material you plan on delivering, and having a short PowerPoint presentation is a great visual tool for you to convey the information. If someone is not confident in your expertise, they are simply not going to do business with you. This does not mean you need to know every answer, nor will you. It is ok to say, “I’m not sure. I will find that answer for you.” If you provide accurate, helpful information and appear confident, people are far more likely to trust you and more likely to do business with you.

Topics: Medicare Prospecting Grow Your Business

3 min read

Medicare Coverage of Cancer Treatment

By Dan Mangus, Vice President of Sales, Senior Marketing Specialists on 4/19/22 10:55 AM

If an agent working with people on Medicare is even somewhat successful at what they do, hundreds of people, if not thousands, will depend on them. The statistics are not merely numbers but hard facts that impact real people. For example, out of 100 clients, statistically, in the US, an estimated 40 out of 100 men and 39 out of 100 women will develop cancer during their lifetime. That means you are very likely to have the opportunity to help many of your clients deal with the financial impact of cancer. Knowing how Medicare will work for treatment and having a publication ready to share will show them that you are a qualified advisor.

Topics: Health Care Medicare Insurance

3 min read

How to Help Your Clients Choose the Right Medicare Coverage

By John Norce on 3/24/22 1:00 PM

The famous New York Yankee catcher Yogi Berra once said, “When you come to the fork in the road, take it.” While clearly this quote provides humor, it provides no clear path or direction when seeking your destination. Our Medicare options can be viewed as a fork in the road, however, there is a decision to make about which direction to take.

When the time comes for you to start Medicare, your first step is to enroll in Original Medicare. Original Medicare consists of Parts A and B and together they provide comprehensive health insurance for your medical needs. Once securing your enrollment in Original Medicare, the next step is to determine if you will remain on Original Medicare or select a Medicare Advantage plan. Taking the time to understand how each option works will go a long way in selecting the right Medicare plans.

Topics: Health Care Medicare Insurance

5 min read

Medicare Savings Accounts and You: A Primer for Financial Advisors

By Elie Harriett on 3/2/22 2:13 PM

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan with several unique attributes that financial advisors might find quite suitable for some clients. Like any other kind of health insurance, it is not for everybody, and there are certain people who are specifically excluded from these plans. If you have a client who is comfortable with investing and handling money, the MSA provides flexibility options unique in the Medicare market. There is both complexity and nuance to MSA’s. As always, this is a general overview and not designed to promote one company’s MSA plan over another. Always contact the MSA plan or a broker knowledgeable about them to ensure it is available in your area and appropriate for your client.

Topics: Medicare

3 min read

Technology for Selling Medicare Insurance Plans

By Ken Leibow on 2/25/22 10:17 AM

If you take a look around, you will notice all of the noise in the Medicare space. Whether it be the technology platforms for quote and apply, the renewable income stream, or a plethora of prospects, you may think to yourself, where do I start?

Let’s start with the technology platforms. Being able to quote, save, and compare Medicare choices for your clients is imperative. When CMS (Centers for Medicare & Medicaid Services) removed your ability to save drug plans, this opened up innovation in the independent distribution. Now you have the ability and convenience with Search & Save options that allow you to load your clients' medications and then recall that list and simply update it instead of recreating it every year.

.png)

.jpg)

.png?width=300&name=_LUTCF%20%20-%20AT%20web%20(300%20x%20300%20px).png)