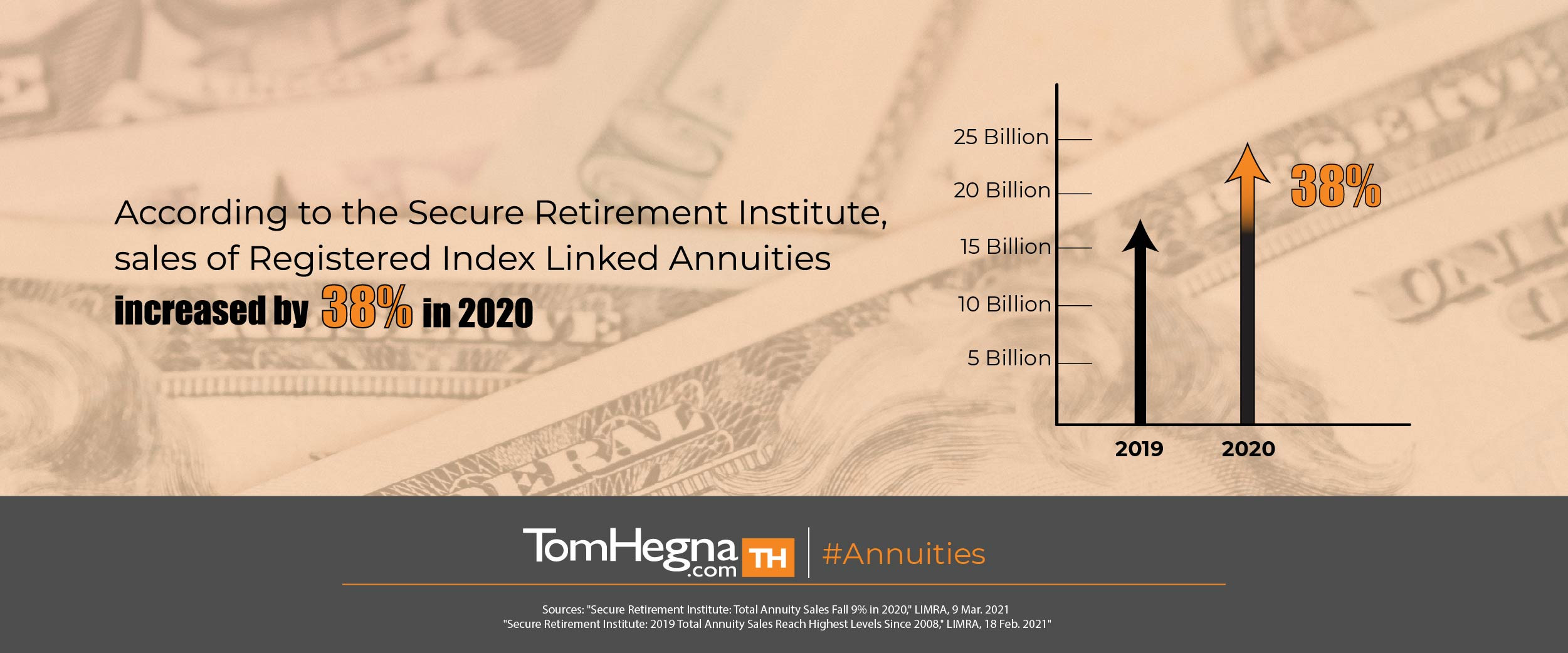

June is one of my favorite months of the year, and not just because summer weather is perfect for golfing. It’s also Annuity Awareness Month! Much of my work is dedicated to spreading the word about how annuities are a key part of an optimal retirement plan. I’ve been happy to see that annuities have been growing in popularity over the last few years. According to LIMRA, in 2020 alone, annuity sales totaled over $219 billion, with variable annuities being the most popular choice. I’m a fan of variable annuities myself, so I thought I’d take some time to look at some reasons why they’re such big sellers.

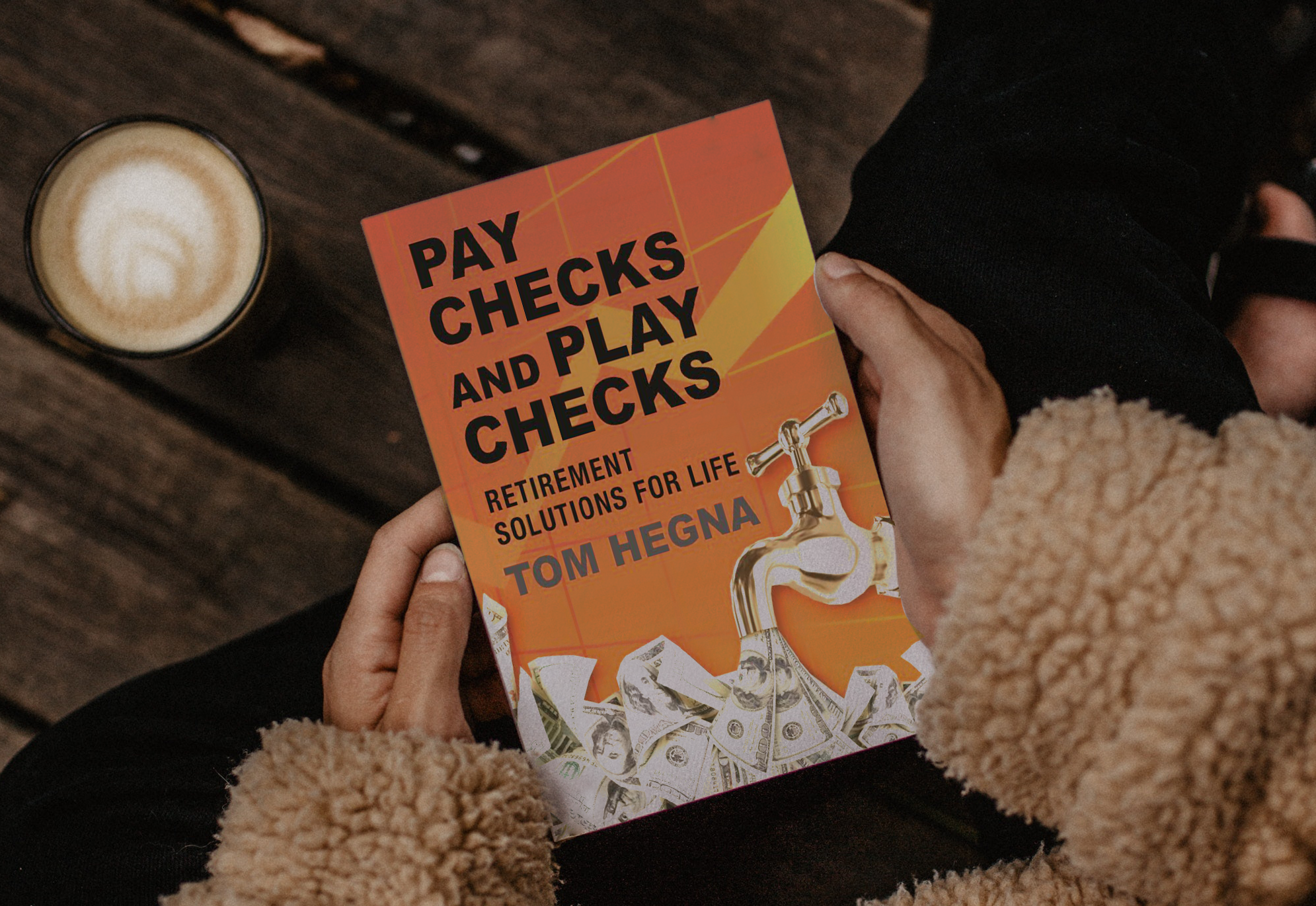

Put simply, variable annuities are deferred annuities that allow you to invest in the market on a tax-deferred basis. In my book Paychecks and Playchecks, I wrote that I liked variable annuities because they are a way for me to “make as much money as I can, without losing the money I’ve already got.” There are a lot of benefits to a variable annuity, including a guaranteed death benefit and a variety of additional riders that can be added on to a variable annuity contract. I've dedicated specific sections of Paychecks and Playchecks to comparing all the different riders that are available. That same LIMRA study showed that one of the most popular types of variable annuities are Registered Index Linked Annuities, or RILAs. These annuities are a blend of fixed and variable annuities that allow you to pick how much market risk you want to assume. Many RILAs are not fee products, so your gains can accumulate with no fees deducted. When introducing products like these to your clients, make sure they’ve read the prospectus and understand exactly how their investment is going to work.

Whether it’s variable, deferred, or immediate, the mathematic and scientific FACTS show that annuities are a key part of achieving an optimal retirement. Inside of a retirement portfolio, an annuity functions like a AAA-rated bond with a CCC-rated yield with zero standard deviation. Advisors should stay up to date with the different types of annuities so they can know how to incorporate annuities into any kind of client situation.

To help educate consumers more about annuities, my flagship book Paychecks and Playchecks: Retirement Solutions for Life serves as a one-stop guide for using annuities in a retirement plan. This book covers many different kinds of annuities, including variable annuities and RILAs. Paychecks and Playchecks is available in my shop now – click here to pick up a copy, or click here to check out special pricing for bulk orders!

See you after checkout,

-Tom Hegna

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)