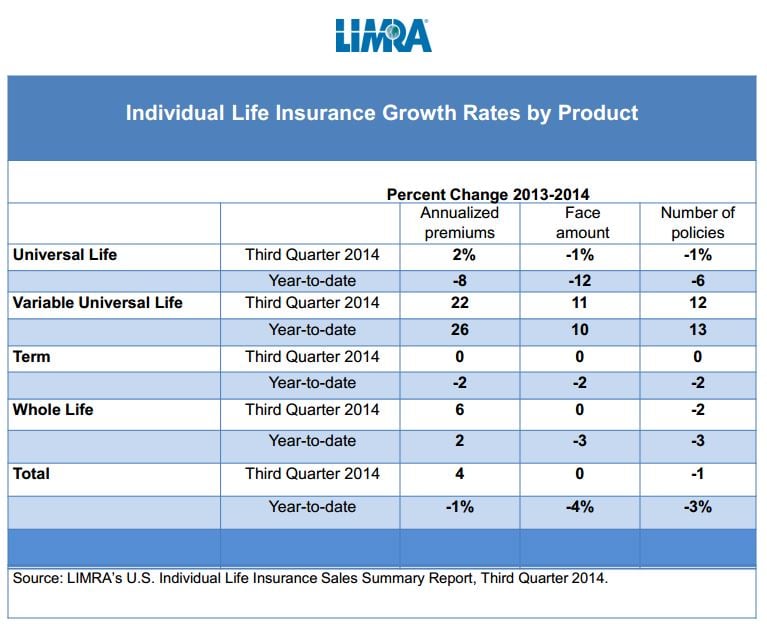

Total individual life insurance new annualized premium improved four percent in the third quarter of 2014, according to LIMRA’s Retail Individual Life Insurance Survey.

In the first nine months of 2014, individual life insurance premium fell one percent. Policy count dropped one percent in the third the quarter and three percent year-to-date (YTD).

Universal life (UL) premium rose two percent in the third quarter but fell eight percent YTD. Lifetime guaranteed universal life dropped 10 percent in the third quarter, following 48 percent and 30 percent drops in the first and second quarters, respectively.

IUL premium jumped 19 percent in the third quarter, resulting in an 18 percent growth YTD. LIMRA finds IUL experienced the strongest growth in absolute dollars for both the quarter and YTD. In the third quarter, IUL represented the majority of all UL premium (51 percent), and 19 percent of overall individual life premium. Total UL market share was 38 percent in the third quarter.

Whole life (WL) premium increased six percent in the third quarter, growing two percent YTD. Policy count fell two percent in the third quarter and three percent in the first nine months of 2014. WL premium represents 32 percent of the total individual life market for the quarter.

Strong growth in VUL premium

Variable universal life (VUL) premium was up 22 percent in the third quarter, resulting in a 26 percent increase YTD. This represents the second strongest growth in absolute dollars and marks the eighth consecutive quarter of positive growth for VUL. VUL represented eight percent of total life insurance sales in the third quarter.

Term life insurance premium was flat in the third quarter, falling two percent YTD. Term’s market share was 22 percent in the third quarter.

View the latest data table on U.S. life insurance sales trends.

For more statistics, visit the newly updated Data Bank.

---------

By LIMRA

.png?width=300&height=300&name=CC%202025%20Ad%20(300%20x%20300%20px).png)

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)

.png?width=300&name=NAIFA-FSP-LH%20with%20tagline%20-%20AT%20blog%20email%20ad%20(300%20x%20250%20px).png)

.png?width=728&height=89&name=2024%20Congressional%20Conference%20(728%20x%2089%20px).png)