It’s a fact, people absorb information best from pictures and stories; and yet, as an industry we continue to present brochures, illustrations and proposals. Should we really be surprised when our prospects aren’t dazzled by seeing tables of numbers they can’t understand, explained with words they’ve never heard?

Granted, there is a time and place for detailed descriptions and analysis, but it isn’t in the first few hours with our prospects. At MoneyTrax, we believe there are two things required for a successful career in financial services: what you know, and what you can communicate. Numbers and charts are a great way to prove what you know, but not a great way to communicate.

If you’ve ever spent time in a medical exam room, you know the routine. First you wait in that lovely paper robe. Then the doctor enters, looks over your chart, and says a few Latin medical terms you can’t understand. Finally, seeing the blank look on your face, the doctor grabs that plastic model of the body part in question and points out the issue and recommended treatment plan.

Why do doctors show these models? Because it’s the only way non-medical people can grasp what’s happening in a short period of time.

It’s no different in our business, as financial professionals we diagnose issues and recommend treatment plans. So why wouldn’t we use a financial model to communicate with our non-financial prospects?

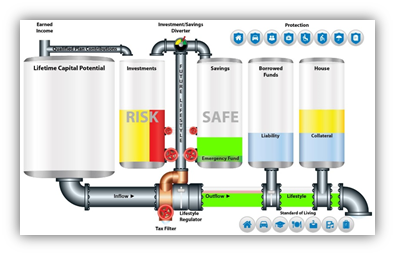

Well, some of us do. MoneyTrax has been using the Personal Economic Model® (PEM) for the last eight years with remarkable success. It’s a picture that shows income, assets, liabilities, home equity, and insurance protection on a single screen.

Once we share and explain this conceptual picture, we can move forward with confidence in detailing issues, opportunities, and solutions.

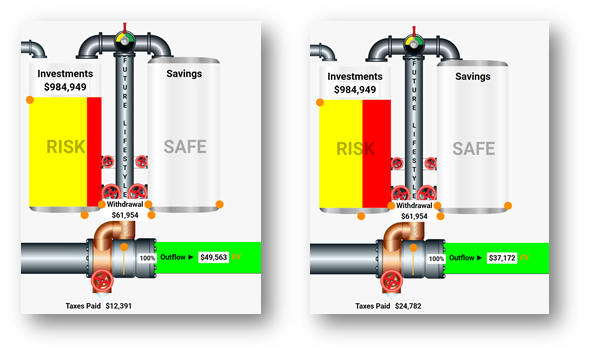

For example, can you imagine helping a client see their future tax liability issues with a deferred qualified plan. While we understand the concepts of deferral and the interaction between withdrawals and marginal tax rates, how do we make it understandable?

We show two PEM pictures side-by-side highlighting the higher marginal tax rates on the future balances, annual taxes paid, and the after-tax spendable income.

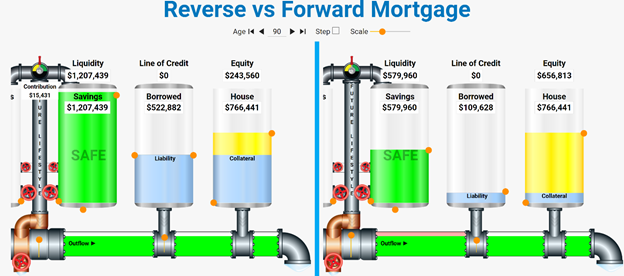

Or imagine trying to explain to a client the difference between a forward and reverse mortgage. With so many moving parts in both types of loans, how do we show the long-term differences between the two?

As you can see, once the client understands the PEM, every financial discussion can be backed up with the model graphics.

In addition to helping insurance and investment financial professionals, MoneyTrax in partnership with Fairway Independent Mortgage has developed a new version of these tools called EquityTrax. They will be used by Lending Officers to help clients understand their options in home equity management.

As an industry, we all benefit when our clients can see their finances in action and make better decisions for their financial future.

NAIFA’s Reverse Mortgage Educational Partner, Fairway Independent Mortgage Corporation, will be co-hosting with MoneyTrax and the Circle of Wealth, an upcoming featured NAIFA Virtual event: The Proof is in the Proposal. Learn about Equity Trax, the newest industry tool for visualizing Reverse Mortgage Loans as a key part of retirement planning. Register at: https://bpc.naifa.org/fairway-november

.

Foot Note:

The Personal Economic Model is a registered trademark of MoneyTrax, Inc.

.png?width=300&height=300&name=CC%202025%20Ad%20(300%20x%20300%20px).png)

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)

.png?width=300&name=NAIFA-FSP-LH%20with%20tagline%20-%20AT%20blog%20email%20ad%20(300%20x%20250%20px).png)

.png?width=728&height=89&name=2024%20Congressional%20Conference%20(728%20x%2089%20px).png)