New findings from the Alliance for Lifetime Income’s 2025 Protected Retirement Income and Planning Study show that financial strain is leading many Americans to sacrifice their own retirement savings and economic well-being in order to support loved ones.

According to the study (now in its seventh year), nearly half of all consumers surveyed said they have made financial sacrifices for family members: 17% of consumers surveyed said they support adult children 26 and older; 10% support grandchildren and 7% support parents or in-laws. More than half say that their financial support affects their retirement savings.

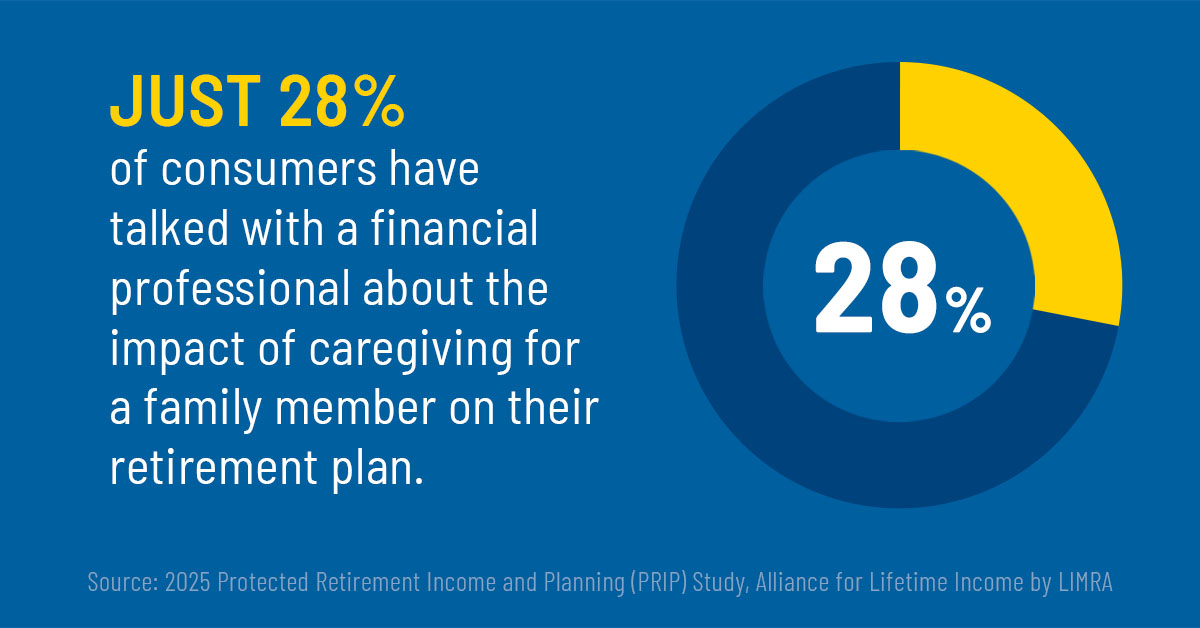

Despite this, only 28 percent reported speaking with a financial professional about the impact on their long-term financial plans.

This is especially concerning for Generation X, who express the lowest levels of retirement confidence in the study. As the earliest members of Gex X turn 60 this year, many are facing the dual challenge of supporting both children and aging parents.

Respondents also reported that they would rather delay home or auto repairs or skip medical care than reduce financial support for family. This is a clear sign that financial professionals need to help clients find solutions that protect both their values and their long-term financial security. Products such as annuities and guaranteed income strategies can help clients achieve this balance.

NAIFA encourages members to use this data to start meaningful conversations. Many clients may not realize how much these sacrifices can affect their future or that help is available.

If you are not a NAIFA member, join today to gain access to more resources that help you serve your clients better.

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)