Home Equity and Reverse Mortgages have rarely been part of Financial Planning for retirement but since housing is typically the largest asset and the largest liability for the average American— it certainly makes sense to find out how it impacts the wealth accumulation phase and the retirement spending plan. Housing costs are usually the largest expense category throughout our lives except for those that are quite wealthy and then taxes become the biggest expense. And interestingly enough— housing costs can certainly affect income tax planning as well!

A proper understanding of the use of traditional (forward) mortgages, and home equity can dramatically impact our overall comprehensive planning for any client. Housing costs can average 25-40% of gross income throughout a client’s entire lifespan. Controlling and decreasing those costs later in life can substantially enhance cash flow and portfolio longevity during the retirement years.

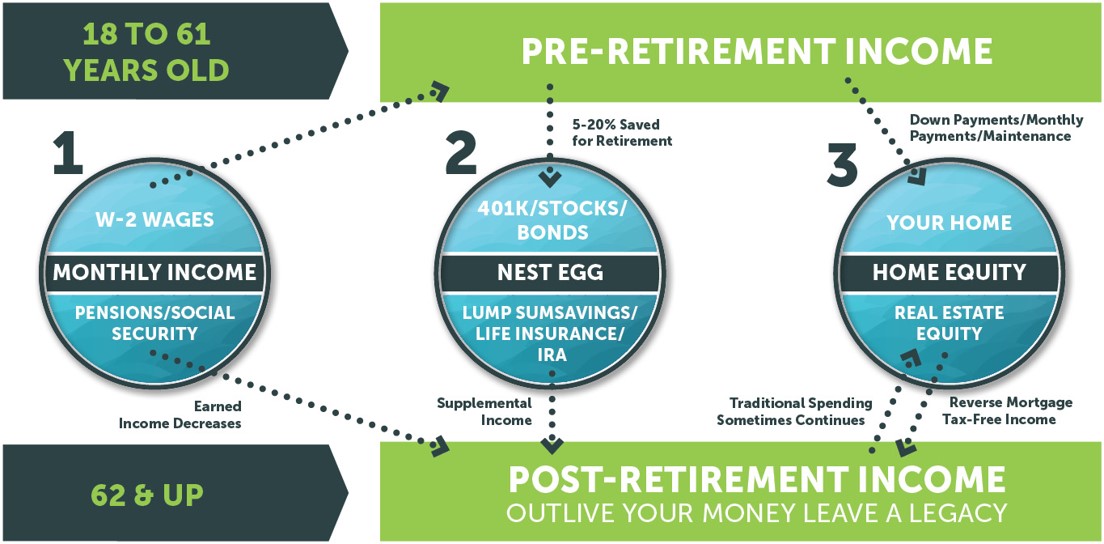

Everyone who is a homeowner has 3 basic buckets of wealth. Bucket 1 is the ability to earn an income while working or to receive a pension or social security after retiring or slowing down in a career. Bucket 2 is the Nest Egg— money put away for the future that is invested for retirement or a future expense. The financial planner is tasked with the job of growing this bucket 2 and making it last. From the time a client invests money in a 401k or an IRA in their 20s or 30s, they fully expect to take it out when they retire in the future. Bucket 3 is home equity. Hundreds of thousands of dollars are typically sent to bucket 3 in the form of house payments—interest and principal, improvements, and other costs. Really bucket 3 is an investment also but it tends to have an emotional attachment because you live there. The culture of our country treats home equity as a sacred cow. Conventional wisdom says you should pay off your mortgage— create a big chunk of home equity as a result and leave it all there until you pass. Then you give the house to the kids (who are now in their 50s and 60s) who don’t want it to live in so they sell it and convert it to cash. Think about it— does that really make sense?

A very simple questions that I have posed to many experienced financial planners for years has kind of stumped them.

“What is the purpose of taking hundreds of thousands of dollars and storing it an illiquid asset that you never use during your lifetime?”

Of course the common answer is — “Because you have to!” Payments are required or you will lose your home and not have a place to live. That is partially correct. It is true that you must make a mortgage payment whenever you borrow money. But, only until you turn 62 and have about 50% equity and then you are allowed to defer your payments to the end of the loan when you pass away or permanently move out. This is what a reverse mortgage does with a safe guarantee that you —nor your heirs— will ever owe more than the home is worth and no matter what happens — you will never have a margin call or get kicked out of your home for as long as you live there— as long as you pay taxes and insurance.

Despite the fact that a reverse mortgage is a safe and efficient way to make the most out of this bucket 3 investment—it is used by less than 5% of the senior population. Most people feel that it is best used as a “loan of last resort” only when all other sources of money are exhausted. Extensive research by financial planning mavens from Harold Evensky to Dr. Wade Pfau has proven that the best way to use reverse mortgages are at 62 instead of at 82 or 92.

When you set aside your old thinking and biases and look at bucket 3 as a nest-egg investment that should be used in retirement income planning just like assets that have been placed in bucket 2 under your care, things change for the better in a dramatic way. Think about it— the more money that is placed in bucket 3— the less money that can be placed in bucket 2. Your clients have less assets under management, less LTC insurance, less cash value life insurance, fewer annuities. All of those assets are more efficient, more liquid, more valuable to you and your heirs than a paid off house sitting completely illiquid in bucket 3.

From a fiduciary perspective it is necessary to change your thinking so you can be of greater help to your baby boomer clients who have invested— to date—over $7.2 Trillion dollars in bucket 3 that is illiquid and has no ability to create one dollar of retirement income without using the maligned and disregarded tool called a reverse mortgage.

Dr. Wade Pfau wrote an endorsement on the back cover of my book Home Equity and Reverse Mortgages, The Cinderella of the Baby Boomer Retirement that said:

“Harlan Accola has made the case in a clear and easy to understand manner for considering a reverse mortgage as part of a responsible retirement income plan. His Cinderella analogy is apt: reverse mortgages are under appreciated and are poised to become more popular with retirees. This book can help many Americans to understand why the conventional wisdom about saving home equity to be used as a last resort in retirement rarely makes much sense.”

For information on how to get a free copy of this book, simple email me at harlana@fairwaymc.com Together, reverse mortgage planners and financial advisors like NAIFA members can change retirement for the better for millions of baby boomers! That is why hundreds of our loan officers at Fairway Independent Mortgage Corp are proud members of NAIFA. They know the importance of working with advisors who manage Bucket 2!

.png?width=300&height=300&name=CC%202025%20Ad%20(300%20x%20300%20px).png)

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)

.png?width=300&name=NAIFA-FSP-LH%20with%20tagline%20-%20AT%20blog%20email%20ad%20(300%20x%20250%20px).png)

.png?width=728&height=89&name=2024%20Congressional%20Conference%20(728%20x%2089%20px).png)