LIMRA’s research finds that 37 percent of policy owners went online for service in 2017, 23 percent higher than in 2014.

LIMRA’s research finds that 37 percent of policy owners went online for service in 2017, 23 percent higher than in 2014.

The study also finds that 74 percent of policy owners said they would go online for service in the future, twice as likely as in 2017.

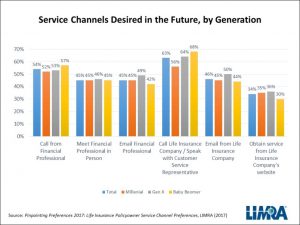

While more policy owners are interested in going online to get help with their policy, they expect to have many options to access service.

Nine in 10 policy owners said they want to be able to speak to a financial professional and three quarters say they want to contact the company directly via phone or mail. LIMRA found, overall, that meeting a financial professional and calling a life insurance company to speak with a customer service representative are still the most chosen service channels, at 44 percent and 45 percent, respectively.

The policy owner’s generation also played a role in their use of service channels. The research shows Millennial policy owners (born between 1981 and 1995) are the most likely to use the most service channels and are most likely to use digital channels, such as email, websites, text, chats and mobile devices to connect, compared to older consumers.

Research shows that the types of transactions influence which the type of channel that policy-owners used. Simpler transactions, such as setting paperless preference and obtaining general information, were more likely to be completed online. Policy owners were more inclined to talk to someone when they conducted more complex business, such as changing their policy face amounts. Policy owners used mail or email more often when they completed services that require documentation, such as name or beneficiary changes.

LIMRA

.png?width=300&height=300&name=CC%202025%20Ad%20(300%20x%20300%20px).png)

.png?width=300&height=600&name=Tax%20Talk%20Graphic%20-%20email%20tower%20(300%20x%20600%20px).png)

.png?width=300&name=NAIFA-FSP-LH%20with%20tagline%20-%20AT%20blog%20email%20ad%20(300%20x%20250%20px).png)

.png?width=728&height=89&name=2024%20Congressional%20Conference%20(728%20x%2089%20px).png)